US Secular Growth Stocks: The Key to Long-Term Wealth

author:US stockS -

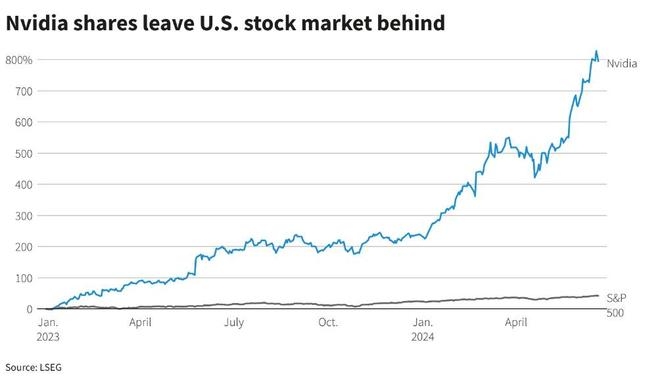

In the ever-evolving landscape of the stock market, secular growth stocks have emerged as a beacon for investors seeking long-term wealth. These stocks represent companies with sustainable growth patterns that can outperform the market over extended periods. In this article, we'll delve into what makes secular growth stocks unique and how they can be a cornerstone of your investment strategy.

Understanding Secular Growth Stocks

Secular growth stocks are characterized by their consistent and long-term growth trends. Unlike cyclical stocks, which are sensitive to economic cycles, secular growth stocks tend to grow regardless of the economic climate. These companies often dominate their industries and have a strong competitive advantage.

Key Characteristics of Secular Growth Stocks

Strong Competitive Advantage: Secular growth stocks typically have a strong competitive advantage, whether it's through proprietary technology, strong brand recognition, or a unique business model. This advantage allows them to maintain high market share and grow their revenue over time.

Sustainable Growth: These companies demonstrate a consistent track record of revenue and earnings growth. They often have a history of increasing sales and profits, even during periods of economic downturn.

High Return on Equity (ROE): Secular growth stocks tend to have a high ROE, indicating that they are efficient at using their capital to generate profits.

Strong Management: The leadership of a secular growth company is crucial. These companies are often led by visionary leaders who have a clear vision for the future and the ability to execute it effectively.

Examples of Secular Growth Stocks

Several companies have demonstrated secular growth over the years. Here are a few notable examples:

Apple (AAPL): As the world's largest technology company, Apple has a strong competitive advantage in the smartphone and computer markets. Its products have a loyal customer base, and the company continues to innovate and expand its product line.

Amazon (AMZN): Amazon has revolutionized the retail industry with its e-commerce platform. The company has also expanded into cloud computing, streaming, and other areas, making it a dominant force in the tech industry.

Microsoft (MSFT): Microsoft has a strong presence in the software industry, with products like Windows, Office, and Azure. The company has also made significant investments in artificial intelligence and cloud computing, further solidifying its position as a leader in the tech industry.

Investing in Secular Growth Stocks

Investing in secular growth stocks requires a long-term perspective. These stocks may not offer the same level of short-term volatility as other types of stocks, but they can provide significant returns over the long term. Here are a few tips for investing in secular growth stocks:

Do Your Research: Before investing in a secular growth stock, it's important to thoroughly research the company and its industry. Understand the company's competitive advantage, growth prospects, and financial health.

Diversify Your Portfolio: While secular growth stocks can be powerful, it's important to diversify your portfolio to mitigate risk. Consider investing in a mix of secular growth stocks, cyclical stocks, and other asset classes.

Stay Patient: Secular growth stocks may not offer immediate returns, but they can provide significant long-term gains. Stay patient and focused on your investment strategy.

In conclusion, secular growth stocks can be a valuable component of your investment portfolio. By understanding their unique characteristics and investing in companies with strong competitive advantages and sustainable growth, you can position yourself for long-term wealth.

new york stock exchange