Understanding US Stock Futures Trading Hours: A Comprehensive Guide

author:US stockS -

If you're involved in the stock market or considering it, understanding the trading hours of US stock futures is crucial. This guide provides a comprehensive overview of when you can trade, the benefits, and key factors to consider.

What Are US Stock Futures?

Stock futures are agreements to buy or sell a stock at a predetermined price at a future date. They are a form of derivative trading and are often used for hedging or speculation purposes. The most popular futures contracts include the S&P 500, the Dow Jones, and the NASDAQ 100.

Trading Hours for US Stock Futures

The trading hours for US stock futures are as follows:

- Pre-market Hours: These hours begin at 4:00 AM ET and end at 9:30 AM ET. During this period, you can place orders, but the orders may not be executed immediately.

- Regular Trading Hours: These hours run from 9:30 AM ET to 4:00 PM ET. This is when the majority of trading occurs.

- Post-market Hours: These hours begin at 4:00 PM ET and end at 8:00 PM ET. During this time, trading is more limited, but it's still possible to execute orders.

Benefits of Trading During US Stock Futures Trading Hours

- Market Liquidity: Trading during regular hours ensures the highest liquidity, making it easier to execute trades quickly and at competitive prices.

- Access to Market News: Regular trading hours coincide with the release of market news, which can significantly impact stock prices.

- Better Risk Management: Trading during regular hours allows you to manage your risk effectively, as you can react to market developments in real-time.

Key Factors to Consider

- Time Zone: Ensure you're aware of the time zone differences if you're trading from outside the United States.

- Trading Platforms: Choose a reliable trading platform that offers access to US stock futures during the specified trading hours.

- Leverage: Be aware of the high leverage involved in futures trading, as it can amplify both profits and losses.

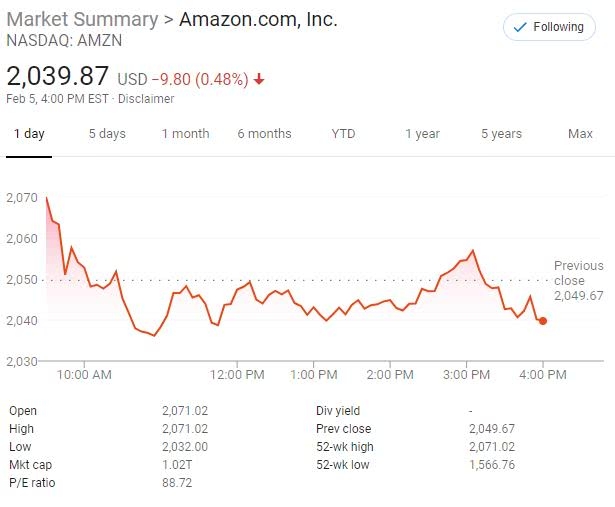

Case Study: Pre-market Gains

Consider a scenario where a company announces positive earnings reports before the regular trading hours. This news can significantly impact the stock price. By trading during the pre-market hours, you can capitalize on this information and potentially make substantial gains.

Conclusion

Understanding the trading hours for US stock futures is essential for anyone looking to engage in futures trading. By knowing when you can trade, the benefits, and the key factors to consider, you can make informed decisions and maximize your trading opportunities.

Remember, trading involves risk, and it's crucial to do thorough research and consider your financial situation before getting involved.

new york stock exchange