Trade U.S. Stocks from Europe: A Comprehensive Guide

author:US stockS -

Are you an investor in Europe looking to diversify your portfolio with U.S. stocks? Trading U.S. stocks from Europe is not only possible but also increasingly popular. This guide will walk you through the process, highlighting the benefits and key considerations for successful trading.

Understanding the Basics

1. Access to the U.S. Market: Trading U.S. stocks from Europe allows you to gain access to a vast array of companies, including some of the world's largest and most successful businesses. This includes giants like Apple, Google, and Amazon, as well as numerous smaller companies with promising growth potential.

2. Diversification: Investing in U.S. stocks can help diversify your portfolio, reducing exposure to domestic market risks. This is particularly beneficial for European investors, who may be more exposed to local economic and political uncertainties.

3. Potential for Higher Returns: Historically, the U.S. stock market has provided higher returns than many European markets. This can be attributed to factors such as higher growth rates, innovation, and a strong regulatory environment.

How to Trade U.S. Stocks from Europe

1. Open a Brokerage Account: The first step is to open a brokerage account with a reputable broker that offers access to the U.S. stock market. Many brokers, such as TD Ameritrade and E*TRADE, provide this service to international clients.

2. Choose a Brokerage Account Type: There are several types of brokerage accounts to choose from, including individual, joint, and corporate accounts. The type of account you choose will depend on your investment goals and needs.

3. Understand the Costs: Trading U.S. stocks from Europe may involve additional costs, such as currency conversion fees, transaction fees, and potentially higher trading commissions. It's important to understand these costs and factor them into your investment strategy.

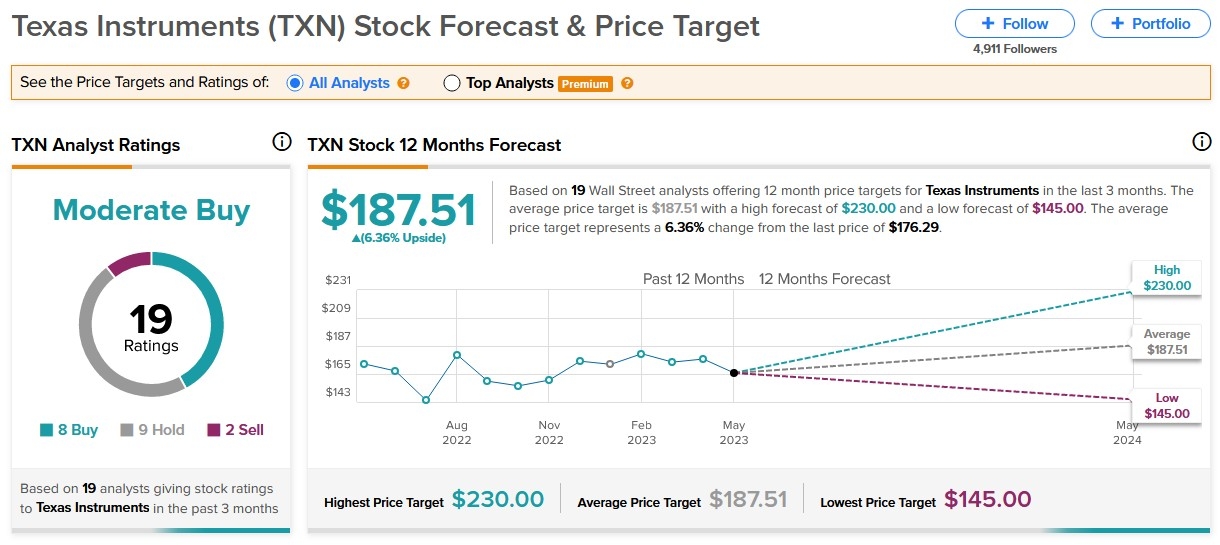

4. Research and Analyze: Just as with domestic stocks, thorough research and analysis are crucial for successful trading. Utilize a variety of resources, including financial news, stock analysis tools, and fundamental analysis techniques.

5. Place Your Orders: Once you've identified a stock you're interested in, you can place your order through your brokerage platform. Be sure to understand the different types of orders, such as market orders and limit orders, and how they work.

Benefits of Trading U.S. Stocks from Europe

1. Access to a Diverse Range of Stocks: As mentioned earlier, trading U.S. stocks allows you to invest in a wide range of companies across various industries, providing more opportunities for diversification.

2. Potential for Higher Returns: The U.S. stock market has historically offered higher returns than many European markets, making it an attractive option for investors looking to maximize their profits.

3. Access to Cutting-Edge Technologies: Investing in U.S. stocks gives you exposure to cutting-edge technologies and innovative companies, which can be a significant advantage in today's rapidly evolving global economy.

4. Enhanced Liquidity: The U.S. stock market is one of the most liquid in the world, making it easier to buy and sell stocks without significant price impact.

Case Study: Investing in U.S. Tech Stocks

Consider an investor in Germany who decides to invest in U.S. tech stocks. By trading U.S. stocks from Europe, this investor gains access to companies like Apple and Microsoft, which are not available on the German stock exchange. Over time, the investor's portfolio has grown significantly, providing a substantial return on investment.

In conclusion, trading U.S. stocks from Europe is a viable and potentially lucrative option for investors looking to diversify their portfolios and access a wide range of companies. By understanding the basics, choosing the right brokerage account, and conducting thorough research, investors can successfully trade U.S. stocks from Europe and potentially benefit from higher returns and enhanced diversification.

new york stock exchange