US Stocks Tumble Friday Ahead of a Christmas Week Vacation

author:US stockS -

As the festive season approaches, the US stock market experienced a downward trend on Friday, signaling investors' caution ahead of the upcoming Christmas week vacation. The decline in stock prices is attributed to various factors, including economic uncertainty, global market fluctuations, and the anticipation of policy changes.

Economic Uncertainty Looms Large

One of the primary reasons for the stock market's tumble on Friday was the lingering economic uncertainty. Investors are concerned about the potential impact of rising inflation, high interest rates, and supply chain disruptions. These factors have contributed to the cautious stance of investors, leading to a sell-off in the stock market.

Global Market Fluctuations Influence US Stocks

Another factor that played a significant role in the stock market's decline was global market fluctuations. As the world grapples with the COVID-19 pandemic, various countries are facing economic challenges, which have impacted global stock markets. The US stock market is not immune to these fluctuations, as it is interconnected with the global economy.

Policy Changes Affecting the Market

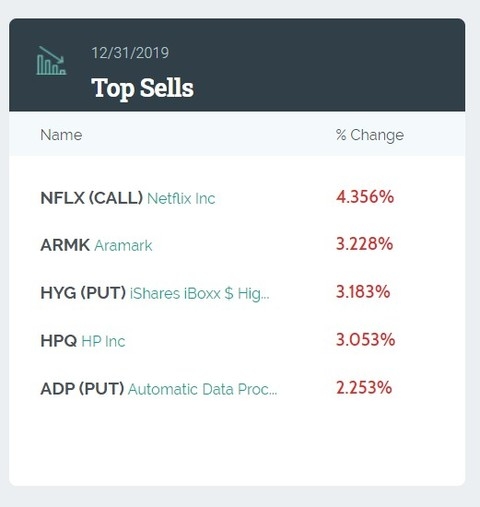

The anticipation of policy changes also contributed to the downward trend in the stock market. Investors are concerned about the potential impact of these changes on various sectors, including technology, finance, and energy. The uncertainty surrounding these policy changes has led to a cautious approach among investors, resulting in a sell-off.

Tech Sector Suffers Heavy Losses

Among the major sectors affected by the stock market's tumble was the technology sector. Companies like Apple, Amazon, and Google saw their shares decline significantly on Friday. The tech sector has been a significant driver of the stock market's growth in recent years, but the recent downturn suggests that investors are becoming increasingly concerned about the sector's future.

Retail Sector Shows Resilience

In contrast to the tech sector, the retail sector showed some resilience during the recent market downturn. Companies like Walmart and Target saw their shares hold steady, indicating that consumers are still spending despite the economic uncertainty. This resilience in the retail sector suggests that the overall consumer outlook remains positive.

Case Study: Apple's Stock Decline

A prime example of the recent stock market downturn is the decline in Apple's stock. The technology giant saw its shares fall by over 3% on Friday, marking its worst performance in months. The decline in Apple's stock is attributed to various factors, including concerns about the company's revenue growth and the global economic uncertainty.

Conclusion

The stock market's tumble on Friday, ahead of the Christmas week vacation, is a reflection of the economic uncertainty and global market fluctuations that investors are currently facing. While some sectors, like retail, have shown resilience, others, like technology, have suffered heavy losses. As the festive season approaches, investors remain cautious, anticipating the potential impact of policy changes and economic challenges in the coming year.

new york stock exchange