How Will US Stocks Fare in a Dollar Collapse?

author:US stockS -

In recent years, the global economy has become increasingly interconnected, with the US dollar playing a central role as the world's primary reserve currency. However, with growing concerns over the dollar's stability, many investors are wondering how US stocks will fare in the event of a dollar collapse. This article delves into the potential implications for US stocks and provides insights into how investors can navigate this challenging scenario.

Understanding the Dollar Collapse

A dollar collapse refers to a situation where the value of the US dollar significantly depreciates against other major currencies. This could be caused by various factors, including economic instability, inflation, or geopolitical tensions. A collapse in the dollar would likely lead to a surge in the prices of commodities and imports, putting upward pressure on inflation and potentially leading to a recession.

Impact on US Stocks

The impact of a dollar collapse on US stocks can be both positive and negative, depending on the specific sector and the nature of the collapse. Here are some key factors to consider:

1. Inflation-Resistant Sectors

Stocks in sectors that are less sensitive to inflation, such as consumer staples, healthcare, and utilities, may perform relatively well during a dollar collapse. These sectors often offer stable dividends and can provide a level of protection against rising prices.

2. Commodities-Linked Stocks

On the other hand, stocks in sectors heavily exposed to commodities, such as energy, materials, and mining, could benefit from a dollar collapse. As the dollar weakens, the prices of commodities like oil, gold, and copper may rise, boosting the earnings of companies in these sectors.

3. Multinational Companies

US stocks of multinational companies with significant overseas operations may also be insulated from a dollar collapse. These companies can benefit from revenue growth in foreign currencies, which can help offset the negative impact of a weaker dollar on their US earnings.

4. Risky Assets

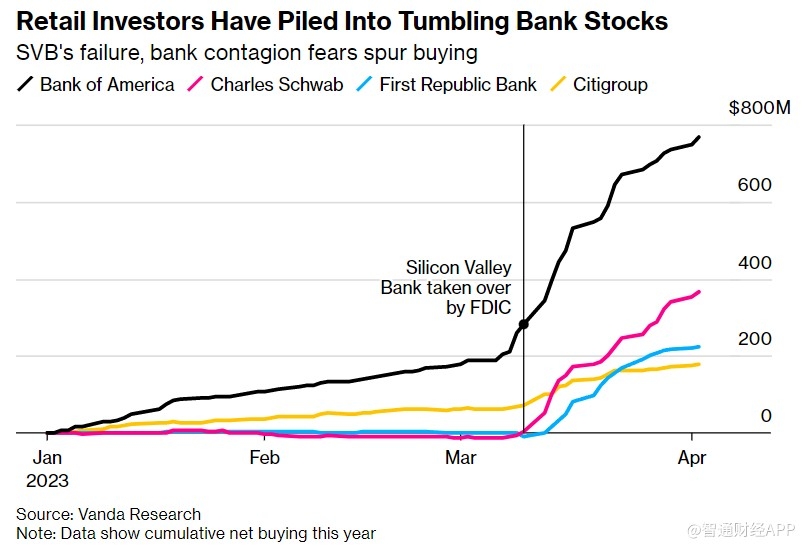

However, stocks in sectors that are highly correlated with the economy, such as consumer discretionary, financials, and real estate, may suffer during a dollar collapse. These sectors are more sensitive to economic downturns and inflationary pressures.

Navigating the Dollar Collapse

Investors looking to navigate a dollar collapse should consider the following strategies:

1. Diversification

Diversifying their portfolios across various sectors and asset classes can help investors mitigate the risks associated with a dollar collapse. By allocating investments in inflation-resistant sectors and commodities-linked stocks, investors can potentially protect their wealth.

2. hedging

Hedging strategies, such as purchasing dollar put options or investing in foreign currencies, can help protect against the depreciation of the US dollar. However, these strategies come with their own risks and should be carefully evaluated.

3. Staying Informed

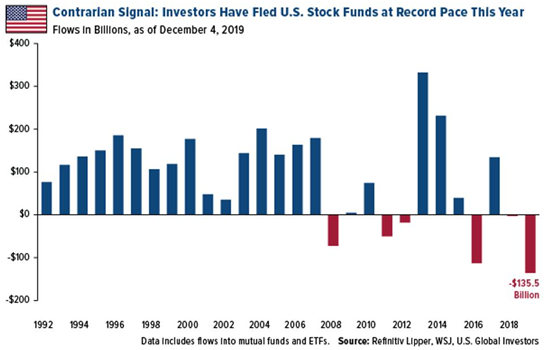

Keeping up with economic news and trends can help investors stay ahead of potential risks. By staying informed, investors can make informed decisions about their investments and adjust their portfolios accordingly.

Case Studies

Historical examples, such as the Plaza Accord in 1985 and the Asian financial crisis in 1997, provide valuable lessons on the impact of currency collapses on stock markets. In these instances, stocks in inflation-resistant sectors and commodities-related sectors performed relatively well, while stocks in economically sensitive sectors experienced significant declines.

In conclusion, a dollar collapse could have significant implications for US stocks. However, by understanding the potential risks and adopting a well-diversified investment strategy, investors can navigate this challenging scenario and potentially protect their wealth.

new york stock exchange