Canada Stocks vs. US Stocks: A Comprehensive Guide

author:US stockS -

Investing in stocks is a popular way to grow wealth, but choosing the right market can be daunting. When considering your options, you might have wondered, "Are Canada stocks better than US stocks?" This article delves into the key differences between Canadian and U.S. stocks, helping you make an informed decision for your investment portfolio.

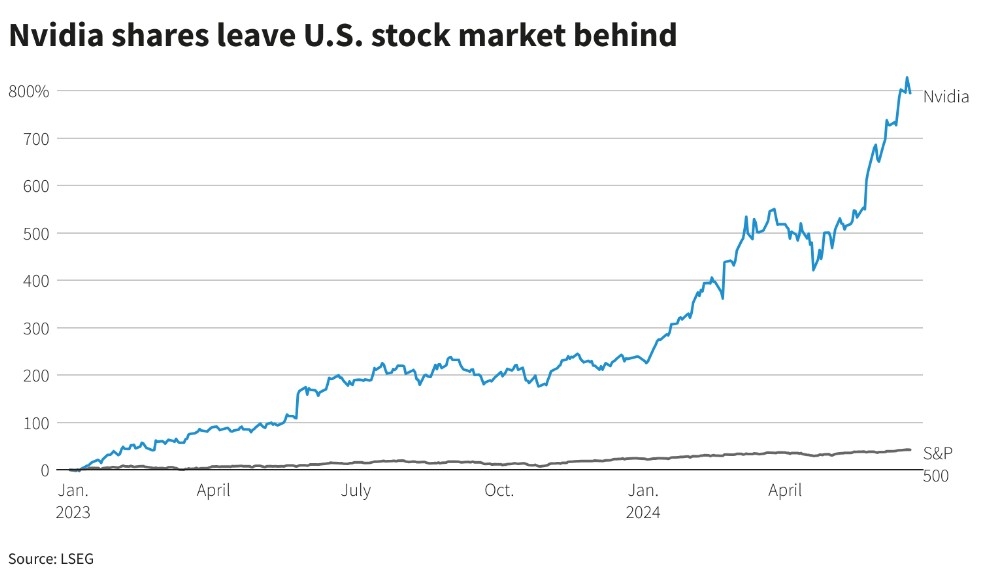

Market Size and Growth

One of the first factors to consider is the size of the market. The U.S. stock market is the largest in the world, with a market capitalization of over

Dividends and Yield

Another key difference is the dividend yield. U.S. stocks tend to have lower dividend yields compared to Canadian stocks. This is because Canadian companies often pay out a higher percentage of their earnings as dividends, making them more attractive to income-focused investors. For example, the S&P/TSX Composite Index, which tracks the performance of the top 300 companies listed on the Toronto Stock Exchange, has a dividend yield of around 3.5%, while the S&P 500 has a dividend yield of around 2%.

Sector Representation

The sectors represented in each market also differ significantly. The U.S. stock market is heavily focused on technology, healthcare, and consumer discretionary sectors. This is due to the presence of large, established companies like Apple, Amazon, and Google. In contrast, the Canadian stock market is more diversified, with a significant presence of energy and materials sectors. This can provide investors with exposure to different economic cycles and sectors.

Currency Exposure

Currency exposure is another important consideration. When investing in U.S. stocks, you are exposed to the U.S. dollar. If the Canadian dollar strengthens against the U.S. dollar, your returns in Canadian currency may be negatively impacted. Conversely, investing in Canadian stocks exposes you to the Canadian dollar, which can be beneficial if the Canadian dollar strengthens.

Regulatory Environment

The regulatory environment also differs between the two markets. The U.S. Securities and Exchange Commission (SEC) is one of the most stringent regulatory bodies in the world, ensuring transparency and accountability in the financial markets. In Canada, the Ontario Securities Commission (OSC) and other provincial regulators oversee the market, with a focus on investor protection.

Case Study: Royal Bank of Canada (RBC) vs. JPMorgan Chase (JPM)

To illustrate the differences between Canadian and U.S. stocks, let's compare Royal Bank of Canada (RBC) and JPMorgan Chase (JPM). RBC is a leading financial institution in Canada, with a market capitalization of approximately $200 billion. It has a dividend yield of around 4%, making it an attractive option for income-focused investors.

JPMorgan Chase, on the other hand, is one of the largest financial institutions in the U.S., with a market capitalization of over $3 trillion. Its dividend yield is around 2.5%, which is lower than RBC. However, JPMorgan Chase offers greater diversification and exposure to the U.S. economy.

In conclusion, when deciding between Canada stocks and U.S. stocks, it's important to consider factors such as market size, growth potential, dividend yields, sector representation, currency exposure, and regulatory environment. Both markets offer unique opportunities, and the right choice depends on your investment goals and risk tolerance.

new york stock exchange