Analyst Upgrades US Stocks: What You Need to Know Today

author:US stockS -

In the world of finance, staying ahead of market trends is crucial. Today, we're diving into the latest buzz: analysts have upgraded their outlook on US stocks. This piece will explore what this means for investors and the potential opportunities it presents.

What Does an Upgrade Mean?

When an analyst upgrades a stock, it means they've revised their rating from neutral or negative to positive. This indicates a belief that the company's performance will improve in the near future. It's a sign that the market might be about to witness a surge in investor confidence.

Key Stocks in Focus

Several prominent US stocks have been upgraded recently. Here's a look at a few:

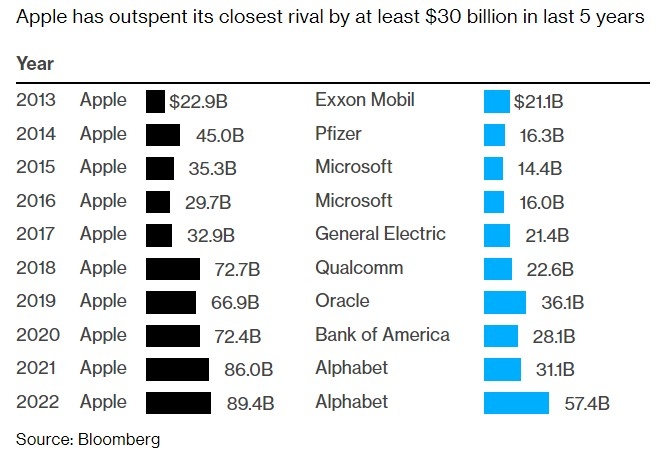

Apple Inc. (AAPL): Analysts at JPMorgan Chase & Co. upgraded Apple's rating from neutral to overweight. They cited the company's robust fundamentals and its growing services segment as key factors.

Microsoft Corporation (MSFT): BofA Securities upgraded Microsoft's rating from neutral to buy. The firm expects strong revenue growth and profitability in the coming years.

Amazon.com, Inc. (AMZN): Citigroup upgraded Amazon from neutral to buy. The analysts believe the company's expansion into new markets, such as healthcare, will drive growth.

Why the Upgrades?

Analysts often upgrade stocks based on several factors:

- Strong Earnings: Companies with impressive earnings reports are more likely to be upgraded.

- Positive Industry Trends: If the industry is performing well, companies within that sector are more likely to be upgraded.

- Management Changes: A new CEO or other significant management changes can also lead to an upgrade.

Investment Opportunities

For investors, these upgrades present exciting opportunities. Here are a few tips for making the most of them:

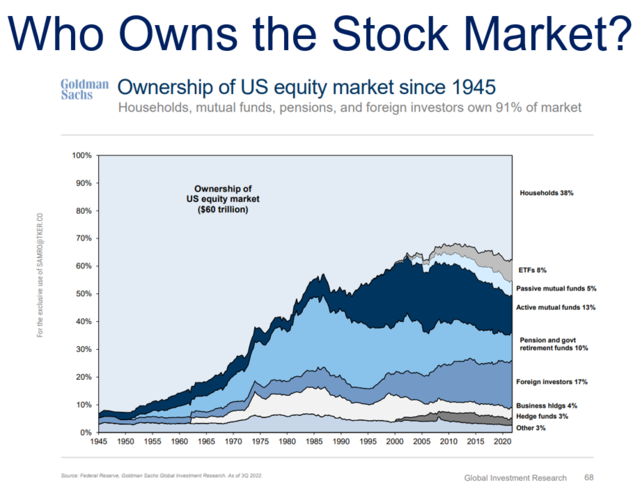

- Diversify Your Portfolio: Don't put all your eggs in one basket. Invest in a mix of upgraded stocks across different sectors.

- Do Your Research: Before investing, research the upgraded companies thoroughly. Understand their business models, financials, and growth prospects.

- Stay Updated: Keep track of market news and developments to stay ahead of potential opportunities.

Case Study: Tesla, Inc. (TSLA)

A prime example of an analyst upgrade leading to significant stock movement is Tesla. Last year, several analysts upgraded the stock, citing the company's strong fundamentals and potential for growth. As a result, Tesla's share price surged, delivering impressive returns to early investors.

Conclusion

Analyst upgrades on US stocks can be a game-changer for investors. By understanding the factors behind these upgrades and conducting thorough research, investors can capitalize on these opportunities. Keep an eye on the market and stay informed to make the most of these exciting times in the stock market.

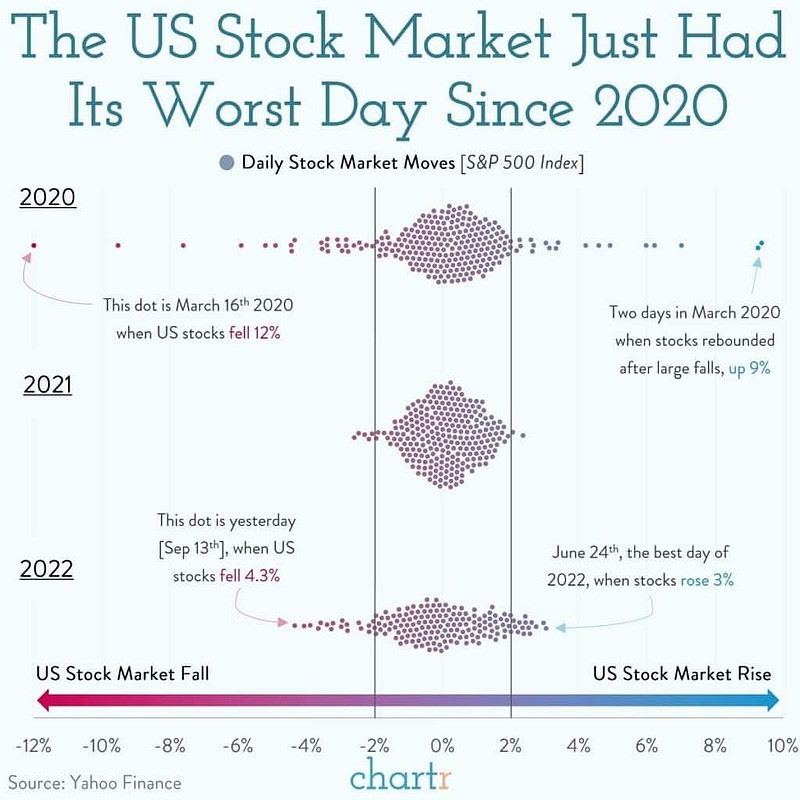

dow and nasdaq today