US Government Shutdown Effect on Stocks: Understanding the Impact

author:US stockS -

The US government shutdown, a recurring event in recent years, has significant implications for the stock market. As investors and traders closely monitor the situation, it's crucial to understand how government shutdowns can affect stocks. This article delves into the impact of government shutdowns on the stock market, providing insights into the potential risks and opportunities.

The Immediate Impact of Government Shutdowns on Stocks

When the US government shuts down, it typically occurs due to a failure to pass a budget or due to a dispute between political parties. The immediate impact on stocks is often negative. Government shutdowns lead to a halt in government spending, which can affect various sectors of the economy.

1. Defense and Government Contractors

One of the most affected sectors during a government shutdown is defense and government contractors. These companies rely heavily on government contracts for their revenue. A shutdown can lead to a significant decrease in orders, causing their stocks to plummet.

2. Government Employees and Services

Government employees, including those in the departments of Defense, Treasury, and Homeland Security, are often furloughed during a shutdown. This can lead to reduced consumer spending and a decrease in economic activity, negatively impacting stocks in sectors like retail and consumer goods.

3. Financial Markets

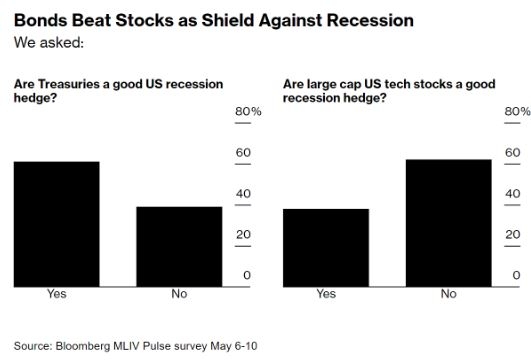

The financial markets themselves can be affected by a government shutdown. Market uncertainty often leads to volatility, and investors may seek safer investments, such as bonds or gold, pushing their prices up.

Long-Term Implications of Government Shutdowns on Stocks

While the immediate impact of a government shutdown on stocks is often negative, the long-term implications can vary. Historical data suggests that government shutdowns have had mixed effects on the stock market.

1. Market Recovery

In some cases, the stock market has recovered relatively quickly after a government shutdown. This is often due to the fact that the shutdown is temporary and the economy has a strong foundation.

2. Sector-Specific Impacts

Certain sectors may be more resilient to the effects of a government shutdown. For example, technology and healthcare companies may not be as affected as defense and government contractor stocks.

3. Political Uncertainty

The long-term impact of a government shutdown on stocks is often tied to the level of political uncertainty. Persistent shutdowns can lead to increased volatility and uncertainty, which can negatively impact the stock market.

Case Studies

To illustrate the impact of government shutdowns on stocks, let's look at a few case studies:

2018 Shutdown: The longest government shutdown in US history occurred in 2018, lasting 35 days. During this period, the S&P 500 index fell by approximately 6.9%. However, the market recovered quickly after the shutdown was resolved.

2019 Shutdown: The government shutdown in 2019 lasted 21 days. The S&P 500 index fell by about 2.9% during this period. Similar to the 2018 shutdown, the market recovered relatively quickly.

In conclusion, government shutdowns can have a significant impact on the stock market. While the immediate impact is often negative, the long-term implications can vary. Investors and traders should closely monitor the situation and consider the potential risks and opportunities associated with government shutdowns.

dow and nasdaq today