How to Invest in Stocks in the US: A Comprehensive Guide

author:US stockS -

Investing in stocks can be a lucrative venture, but it requires knowledge, patience, and a solid strategy. If you're looking to invest in stocks in the US, this guide will provide you with essential information to get started. We'll cover the basics of stock investing, how to choose stocks, and where to invest.

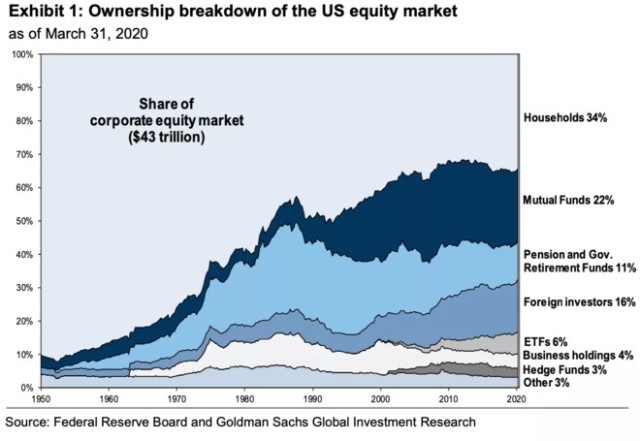

Understanding the Stock Market

Before diving into stock investing, it's crucial to understand the stock market. The stock market is a marketplace where shares of publicly-traded companies are bought and sold. The two most prominent stock exchanges in the US are the New York Stock Exchange (NYSE) and the NASDAQ.

Choosing a Broker

The first step in investing in stocks is to choose a broker. A broker is an intermediary between you and the stock market. They execute your trades and provide access to the stock market. There are several types of brokers, including full-service brokers, discount brokers, and online brokers.

- Full-service brokers offer personalized advice and support, but they charge higher fees.

- Discount brokers provide lower fees and fewer services, but they require more research and self-management.

- Online brokers offer a balance between personalized service and lower fees, making them a popular choice for many investors.

Opening a Brokerage Account

Once you've chosen a broker, the next step is to open a brokerage account. This account will hold your investments and allow you to buy and sell stocks. To open an account, you'll need to provide personal information, such as your name, address, and Social Security number.

Researching Stocks

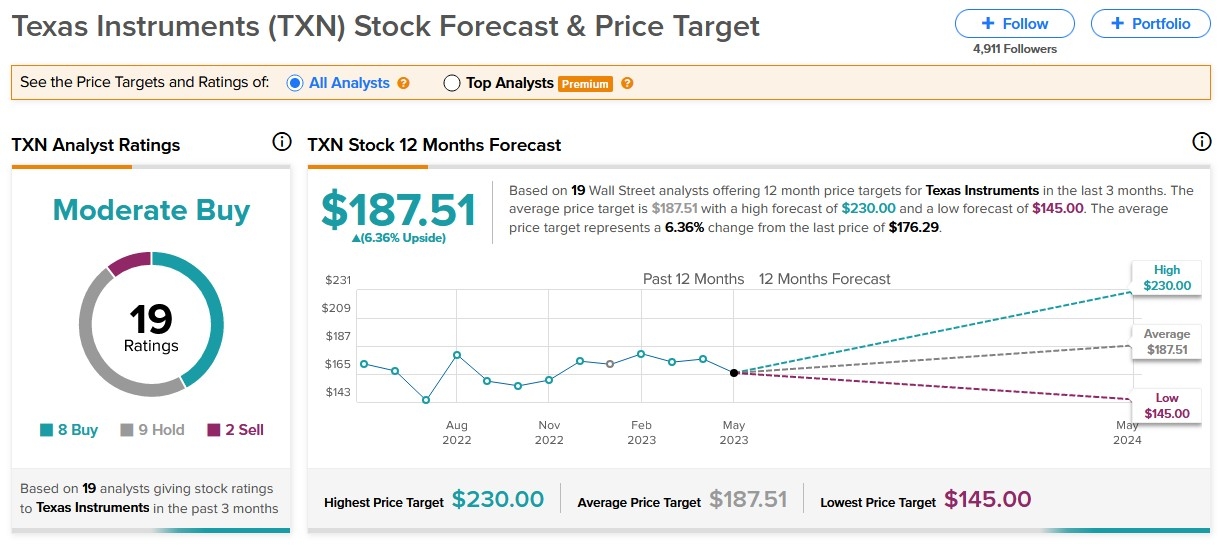

Researching stocks is a critical part of the investment process. This involves analyzing a company's financial statements, earnings reports, and other relevant information. Here are some key factors to consider when researching stocks:

- Earnings: Look for companies with consistent and growing earnings.

- Revenue: Companies with increasing revenue are often a good investment.

- Market Capitalization: Large-cap companies are generally considered safer investments, while small-cap companies offer more growth potential but with higher risk.

- Dividends: Companies that pay dividends can provide a steady income stream.

Diversification

Diversification is an essential strategy for reducing risk in your investment portfolio. By investing in a variety of stocks across different industries and sectors, you can minimize the impact of any single stock's performance on your overall portfolio.

Investment Strategies

There are several investment strategies you can use when investing in stocks:

- Buy and Hold: This strategy involves buying stocks and holding them for the long term, regardless of short-term market fluctuations.

- Value Investing: This strategy focuses on buying stocks that are undervalued by the market.

- Growth Investing: This strategy involves investing in companies with high growth potential.

Case Study: Apple Inc.

Let's take a look at a real-world example. Apple Inc. (AAPL) is a technology giant that has consistently delivered strong financial results. Over the past decade, Apple has seen its stock price increase significantly, making it a valuable investment for many investors.

Conclusion

Investing in stocks can be a rewarding endeavor, but it requires careful planning and research. By understanding the stock market, choosing the right broker, and researching stocks, you can build a diversified investment portfolio that meets your financial goals. Remember to stay patient and disciplined, and don't be afraid to seek advice from financial professionals when needed.

dow and nasdaq today