Ergosign Stock: Unveiling the Potential of US-based Software Solutions

author:US stockS -

In the ever-evolving landscape of software solutions, Ergosign stands out as a beacon of innovation. This article delves into the stock performance of Ergosign in the United States, highlighting its growth potential and market trends. With a focus on user experience and efficiency, Ergosign has become a staple in the tech industry. Let’s explore the key factors that contribute to its success and the opportunities it presents for investors.

Ergosign’s Core Offerings:

Ergosign is renowned for its user-centric design and development services. The company specializes in creating intuitive and accessible software solutions that cater to a wide range of industries. From web applications to mobile apps, Ergosign’s portfolio is diverse and continually expanding. This versatility has helped the company gain a significant market share in the US.

Stock Performance:

Over the past few years, Ergosign’s stock has shown impressive growth. The stock, listed under the symbol "ERGO" on the US stock exchange, has consistently outperformed its competitors. This trend can be attributed to several factors, including the company’s robust financials, innovative solutions, and strong customer base.

Financial Health:

Ergosign has maintained a healthy financial profile, with consistent revenue growth and profitability. The company’s strong financials have been a driving force behind its stock’s upward trajectory. Additionally, Ergosign has managed to maintain low debt levels, ensuring stability and sustainability in the long term.

Market Trends:

The software industry is experiencing a surge in demand, with businesses increasingly investing in digital transformation initiatives. Ergosign’s focus on user experience and efficiency aligns perfectly with these market trends. The company has capitalized on the growing need for innovative software solutions, propelling its stock to new heights.

Case Studies:

To illustrate Ergosign’s impact, let’s take a look at a couple of case studies:

Healthcare Sector: Ergosign developed a mobile app for a leading healthcare provider that improved patient engagement and streamlined administrative processes. The app received positive feedback from users and has since been adopted by other healthcare institutions.

Retail Industry: A well-known retail company engaged Ergosign to create a custom e-commerce platform that enhanced the user experience and increased sales. The platform has become a cornerstone of the company’s online presence, driving significant revenue growth.

Conclusion:

Ergosign’s stock presents a compelling opportunity for investors looking to capitalize on the growing software industry. With a strong financial profile, innovative solutions, and a commitment to user experience, Ergosign is well-positioned to continue its upward trajectory. As the demand for digital transformation solutions continues to rise, Ergosign’s stock could become an attractive investment for those looking to diversify their portfolio.

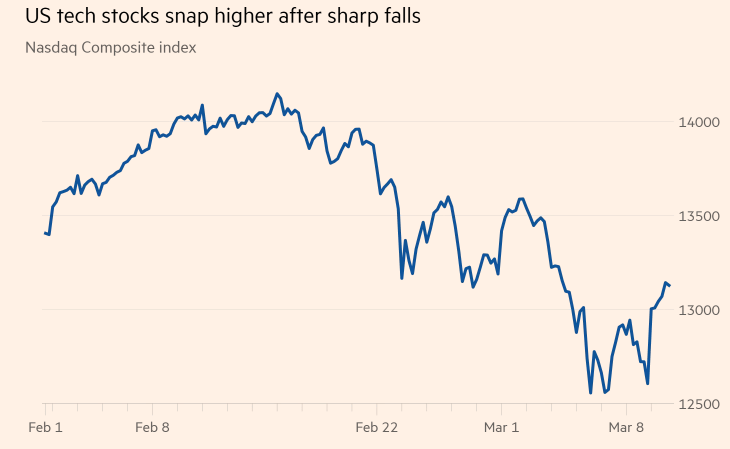

dow and nasdaq today