Google US Stock Price: Current Trends and Future Projections

author:US stockS -

In the ever-evolving world of technology and finance, the stock price of Google (NASDAQ: GOOGL) has always been a subject of intense interest. As one of the most influential companies in the tech industry, Google's stock performance can offer valuable insights into the broader market and the company's strategic direction. In this article, we'll delve into the current trends of Google's US stock price and explore what the future might hold for this tech giant.

Understanding Google's Stock Price

Google, a subsidiary of Alphabet Inc., has been a powerhouse in the tech sector since its inception. The company's stock price reflects its market capitalization, which is a measure of the total value of all its outstanding shares. As of the latest available data, Google's stock price has been on a rollercoaster ride, influenced by various factors such as financial performance, market sentiment, and economic conditions.

Current Trends

1. Financial Performance Google's Q2 2021 earnings report showcased strong revenue growth, driven by advertising and cloud services. The company reported a revenue of $61.9 billion, a 29% increase year-over-year. This robust financial performance has contributed to the upward trend in its stock price.

2. Market Sentiment Investors have been upbeat about Google's future prospects, particularly in the areas of cloud computing and AI. The company's strategic investments in these areas have been well-received by the market, leading to a positive sentiment towards its stock.

3. Economic Conditions The global economic recovery has also played a role in Google's stock price. As businesses continue to invest in digital solutions, Google's advertising and cloud services are well-positioned to benefit from this trend.

Future Projections

1. Cloud Computing Google's investment in cloud computing is expected to pay off in the long run. With companies increasingly moving their operations to the cloud, Google Cloud is well-positioned to capture a significant market share. This could potentially drive Google's stock price higher.

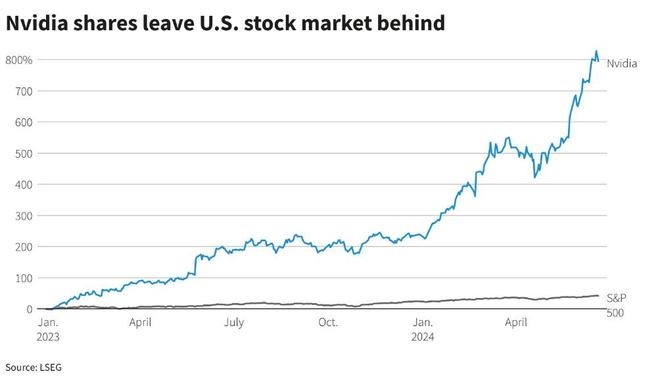

2. AI and Machine Learning Google's leadership in AI and machine learning is another area that could contribute to its stock price growth. The company's advancements in this field have the potential to create new revenue streams and enhance its competitive edge.

3. Regulatory Environment The regulatory environment remains a wildcard for Google's stock price. While the company has faced scrutiny from regulators around the world, any favorable regulatory decisions could provide a boost to its stock.

Case Study: Google's Acquisition of YouTube

One of the most significant moves in Google's history was its acquisition of YouTube in 2006. This acquisition has been a game-changer for the company, significantly contributing to its advertising revenue and market value. The success of this acquisition underscores Google's ability to identify and capitalize on strategic opportunities.

Conclusion

Google's US stock price has been a testament to its resilience and strategic acumen. With a strong financial performance, promising future prospects, and a robust pipeline of innovative products and services, Google remains a compelling investment opportunity. As the tech industry continues to evolve, Google's stock price is likely to reflect its position as a leader in this dynamic sector.

Key Takeaways:

- Google's Q2 2021 earnings report showcased strong revenue growth.

- Google's investments in cloud computing and AI are expected to drive future growth.

- The regulatory environment remains a wildcard for Google's stock price.

- Google's acquisition of YouTube is a prime example of its strategic prowess.

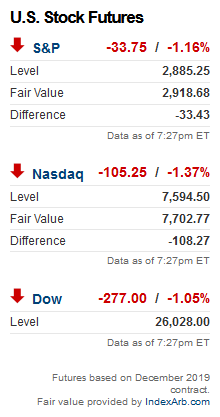

dow and nasdaq today