Title: Future US Stock Market: Predictions and Opportunities

author:US stockS -

In the ever-evolving world of finance, understanding the future of the US stock market is crucial for investors looking to make informed decisions. As we delve into the factors that will shape the stock market's trajectory in the coming years, we'll explore predictions, opportunities, and the potential impact of global events. Let's take a closer look at what the future holds for US stocks.

Economic Growth and Corporate Earnings

One of the primary factors influencing the US stock market is economic growth. With the economy showing signs of recovery, companies are expected to see an increase in revenue and profits. As a result, the stock market is poised to perform well. According to a report by Goldman Sachs, the US economy is expected to grow by 3% in 2023, leading to a rise in corporate earnings.

Tech Stocks: A Major Driver

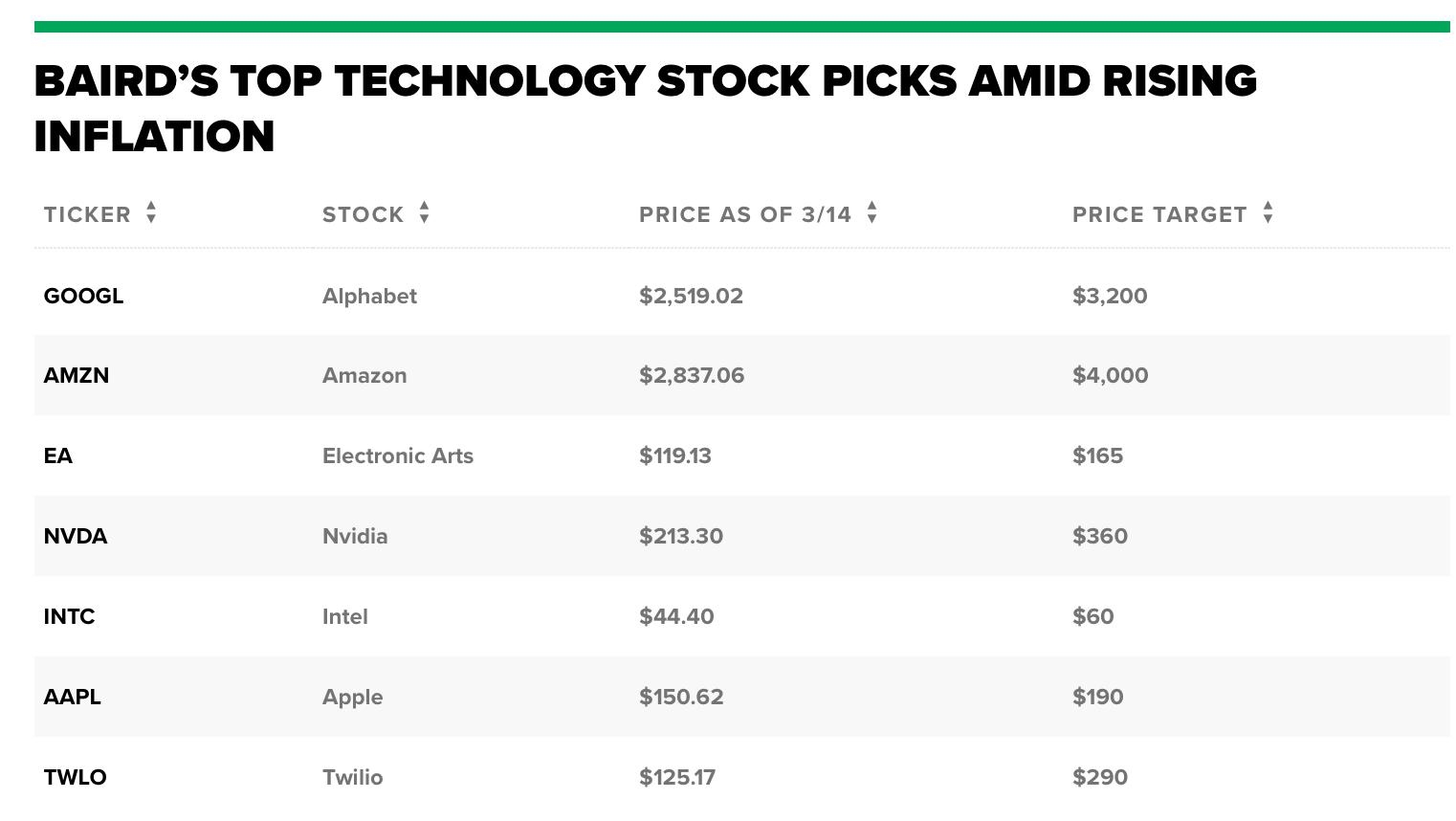

Technology stocks have long been a major driver of the US stock market, and this trend is expected to continue. Companies like Apple, Microsoft, and Amazon have seen significant growth over the years, and their market dominance is likely to persist. With the rise of cloud computing, 5G technology, and artificial intelligence, tech stocks will continue to play a crucial role in the market's future.

Impact of Global Events

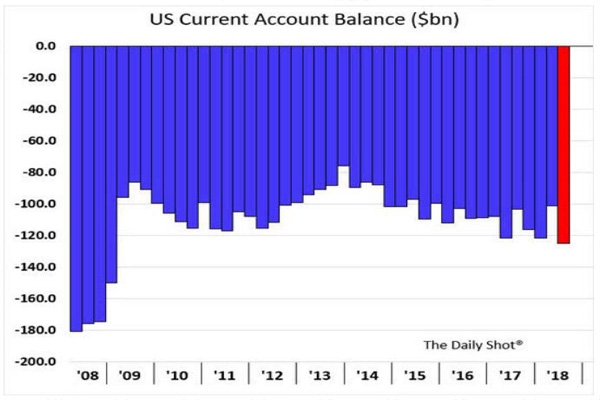

Global events can have a significant impact on the US stock market. Geopolitical tensions, trade disputes, and economic crises can lead to volatility and uncertainty. However, history has shown that the stock market tends to recover from these events. For example, the 2020 COVID-19 pandemic led to a sharp decline in stock prices, but the market has since rebounded.

Sector Rotation and Diversification

As the market evolves, investors will likely see sector rotation and diversification becoming more prevalent. With the rise of green energy and sustainable investing, sectors like renewable energy and electric vehicles are expected to gain traction. Additionally, healthcare and biotechnology will continue to be important sectors due to advancements in medical research and technology.

Dividend Stocks: A Safe Haven

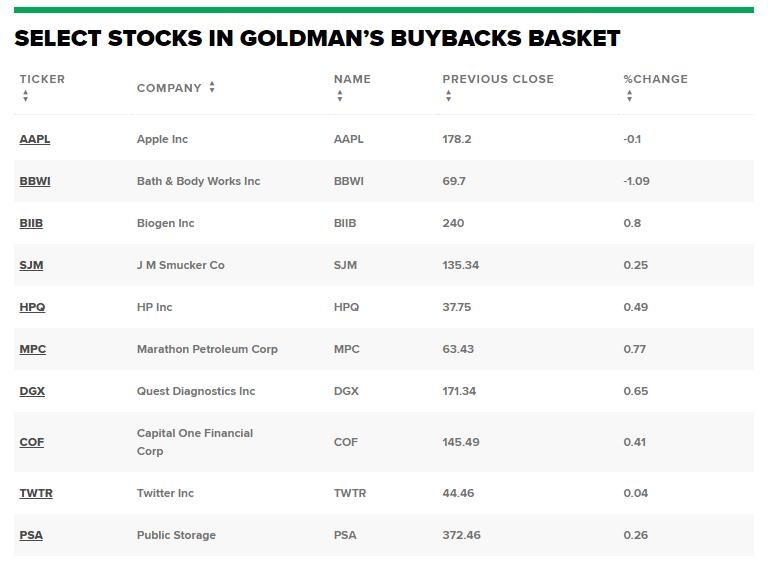

For investors seeking stability and income, dividend stocks remain a safe haven. With interest rates at historic lows, dividend yields have become more attractive. Companies like Johnson & Johnson and Procter & Gamble have long histories of paying dividends, making them popular choices for income-focused investors.

Case Study: Tesla, Inc.

Tesla, Inc. is a prime example of a company that has revolutionized the stock market. Founded in 2003, Tesla has become a global leader in electric vehicles and renewable energy. Its stock has seen meteoric growth, and it's now one of the most valuable companies in the world. This case study highlights the potential for innovation and disruption in the stock market.

In conclusion, the future of the US stock market looks promising, driven by economic growth, technological advancements, and diversification. However, it's essential for investors to remain vigilant and stay informed about the market's changing dynamics. By focusing on factors like economic indicators, sector trends, and global events, investors can make informed decisions and navigate the stock market's future successfully.

us stock market today