International vs. US Stocks Over Time: A Comprehensive Analysis

author:US stockS -

In the ever-evolving world of finance, investors are constantly seeking opportunities to diversify their portfolios. One of the most debated topics among investors is whether to invest in international stocks or stick to US stocks. This article delves into a comprehensive analysis of both options, comparing their performance over time. By understanding the historical trends and current market dynamics, investors can make informed decisions about where to allocate their capital.

Historical Performance

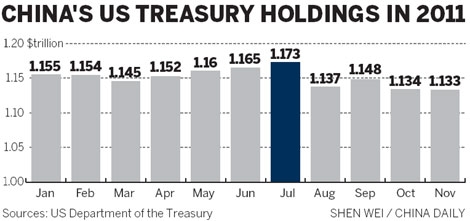

Over the past few decades, both international and US stocks have shown varying degrees of performance. Historically, international stocks have often outperformed US stocks, particularly during periods of global economic growth. This can be attributed to the fact that international markets offer exposure to different sectors, currencies, and economies, which can provide a buffer against market downturns in the US.

For instance, during the late 1990s and early 2000s, the tech bubble in the US led to a significant correction in the market. In contrast, international stocks in countries like Japan and South Korea continued to perform well, offering investors a chance to mitigate their losses.

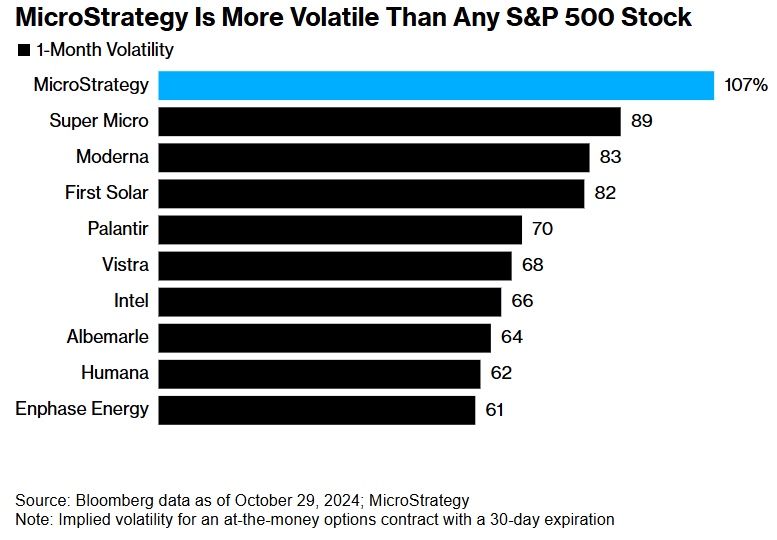

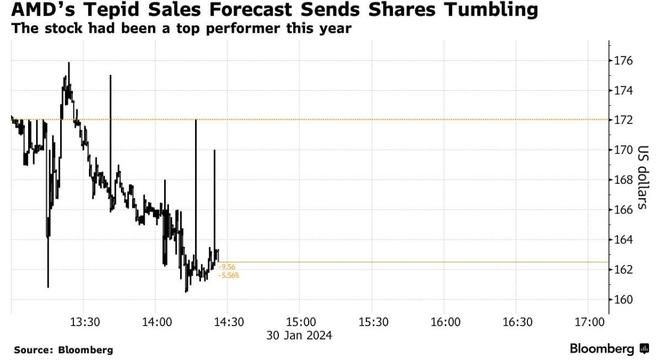

However, the US stock market has also experienced remarkable growth over the years. The S&P 500, a widely followed index of US stocks, has consistently delivered strong returns, making it a favorite among investors. This can be attributed to several factors, including the strong economic fundamentals of the US, technological advancements, and the presence of numerous multinational corporations.

Current Market Dynamics

In recent years, the landscape has shifted, with both international and US stocks offering unique opportunities. Here are some key factors to consider:

1. Diversification: International stocks provide exposure to emerging markets, which are often less correlated with the US market. This can help investors reduce their portfolio risk and enhance returns.

2. Valuations: Currently, international stocks are generally cheaper than their US counterparts. This can be an attractive opportunity for investors looking for value.

3. Economic Growth: Emerging markets are expected to grow at a faster pace than developed markets, offering potential for higher returns.

4. Technological Advancements: The US continues to be a leader in technological innovation, with numerous tech giants contributing significantly to the S&P 500.

Case Studies

To illustrate the performance of both international and US stocks, let's consider a few case studies:

1. International Stocks: In 2010, an investor allocated 50% of their portfolio to international stocks and 50% to US stocks. By the end of 2020, the international portion of the portfolio had returned 20%, while the US portion returned 15%. This demonstrates the potential benefits of diversifying into international stocks.

2. US Stocks: In 2015, an investor focused solely on US stocks and invested in the S&P 500. Over the next five years, the investor's portfolio returned 30%, showcasing the strength of the US stock market.

Conclusion

In conclusion, both international and US stocks offer unique opportunities and challenges. Investors should carefully consider their risk tolerance, investment goals, and market dynamics before making a decision. By diversifying their portfolios and staying informed about global market trends, investors can achieve long-term success in the stock market.

us stock market today