Can Russians Invest in the US Stock Market?

author:US stockS -

Understanding the Potential for International Investment

In a globalized world, cross-border investments have become more accessible than ever before. One of the questions that often arise is whether Russians can invest in the US stock market. The answer is a resounding yes, but it comes with certain conditions and considerations. This article delves into the nuances of investing for Russians in the US stock market, including the process, legalities, and potential risks.

The Legal Framework

The first thing to consider is the legal framework surrounding international investment. The US has a comprehensive set of regulations in place to manage cross-border investments. The Securities and Exchange Commission (SEC) plays a crucial role in overseeing these investments and ensuring compliance with regulations.

Russians looking to invest in the US stock market must adhere to these regulations. This includes registering with the SEC and providing detailed information about their financial situation. Additionally, they must understand the tax implications of their investments, as the US has specific tax laws for international investors.

Investment Options

Russians have a variety of options when it comes to investing in the US stock market. The most common routes include:

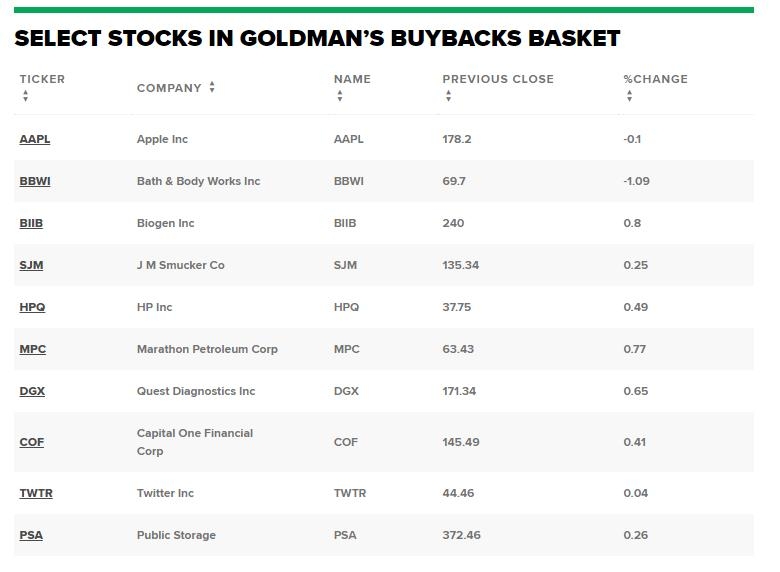

- Individual Stocks: This involves purchasing shares of individual companies listed on US exchanges like the New York Stock Exchange (NYSE) and the NASDAQ.

- Mutual Funds: These are investment funds that pool money from multiple investors to buy a diversified portfolio of stocks, bonds, or other assets.

- ETFs (Exchange-Traded Funds): Similar to mutual funds, ETFs are designed to track the performance of a specific index, such as the S&P 500.

The Process

The process of investing in the US stock market for Russians involves several steps:

- Open a Brokerage Account: The first step is to open a brokerage account with a US-based brokerage firm. This firm will act as an intermediary between the investor and the stock market.

- Complete the Registration Process: As mentioned earlier, Russians must register with the SEC and provide detailed information about their financial situation.

- Fund the Account: Once the account is set up, the investor needs to fund it with US dollars.

- Research and Invest: The investor can then research companies and make investment decisions.

Risks and Considerations

While investing in the US stock market offers potential benefits, it also comes with risks. Some of the key considerations include:

- Market Risk: The stock market can be volatile, and investors should be prepared for potential losses.

- Currency Risk: Fluctuations in the exchange rate between the Russian ruble and the US dollar can impact returns.

- Political Risk: International relations and political events can affect the US stock market.

Case Studies

One notable example is the Russian investor who invested in US tech stocks during the dot-com boom of the late 1990s. Despite the market's eventual crash, the investor's diversified portfolio allowed them to recover and even profit in the long run.

Conclusion

In conclusion, Russians can invest in the US stock market, but they must navigate the legal framework, understand the investment options, and be aware of the risks involved. With careful planning and research, investing in the US stock market can be a valuable addition to a diversified investment portfolio.

us stock market today