US Stock Market After Trump: A Comprehensive Analysis

author:US stockS -

Since the election of Donald Trump as the 45th President of the United States, the US stock market has experienced significant fluctuations. This article delves into the impact of Trump's presidency on the stock market, providing a comprehensive analysis of the key factors at play.

The Trump Effect on the Stock Market

Stock Market Growth

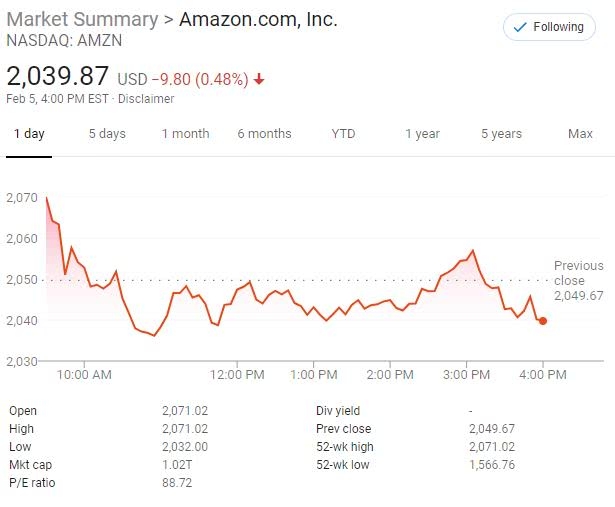

One of the most notable impacts of Trump's presidency on the stock market has been the significant growth. During his tenure, the S&P 500 index, a widely followed benchmark for the performance of the stock market, surged by over 30%. This growth can be attributed to several factors.

Firstly, tax cuts were a cornerstone of Trump's economic policy. These cuts, which took effect in 2017, reduced corporate tax rates from 35% to 21%. This, in turn, led to increased profits for corporations, which were then reinvested into the stock market, driving up share prices.

Secondly, deregulation has been another key factor. Trump's administration has rolled back numerous regulations, which has allowed businesses to operate more freely and increase their profitability. This, combined with the tax cuts, has created a fertile environment for stock market growth.

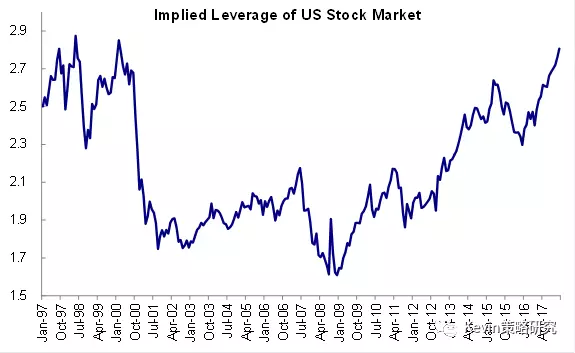

Market Volatility

Despite the overall growth, the stock market under Trump has also experienced increased volatility. This can be attributed to several factors, including Trump's unpredictable behavior and policy shifts.

For instance, Trump's trade wars with China and other countries have caused uncertainty in the market. These trade tensions have led to fluctuations in the stock market, as investors remain wary of the potential impact on the global economy.

Additionally, Trump's Twitter use has sometimes contributed to market volatility. His tweets have the potential to cause panic or excitement among investors, leading to rapid price movements.

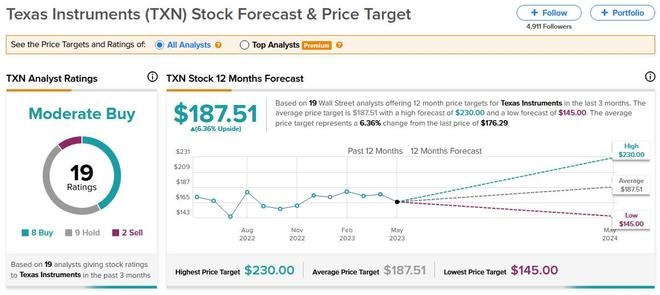

Sector Performance

The impact of Trump's presidency on the stock market has also been evident in the performance of different sectors. Technology and financial services have been the standout sectors, with significant growth in both.

Technology companies, such as Apple and Microsoft, have seen their share prices soar under Trump. This can be attributed to the favorable regulatory environment and the increasing demand for technology products and services.

Financial services companies, on the other hand, have benefited from the tax cuts and deregulation. This has led to increased profitability and share price growth for companies such as JPMorgan Chase and Goldman Sachs.

Case Studies

One of the most significant cases involving Trump's impact on the stock market is the Trump Organization itself. Since Trump took office, the value of his company's shares has increased significantly. This is a testament to the positive impact of his presidency on the stock market.

Another notable case is that of Walmart, which has seen its share price surge under Trump. This can be attributed to the favorable regulatory environment and the tax cuts, which have allowed the company to increase its profitability.

Conclusion

In conclusion, the impact of Trump's presidency on the US stock market has been significant. While the market has experienced significant growth, it has also been marked by increased volatility. The key factors driving this growth include tax cuts, deregulation, and favorable policy shifts. However, the unpredictable nature of Trump's presidency has also contributed to market volatility. Overall, the stock market under Trump has been a complex landscape, characterized by both growth and uncertainty.

us stock market live