How to Buy a US Stock: A Comprehensive Guide

author:US stockS -

Are you interested in investing in the US stock market but unsure of how to get started? Buying US stocks can be a lucrative opportunity, but it requires knowledge and a well-thought-out strategy. In this comprehensive guide, we will walk you through the essential steps to buy a US stock, from opening a brokerage account to executing the trade.

1. Choose a Brokerage Account

The first step in buying a US stock is to open a brokerage account. A brokerage account is a type of account that allows you to buy and sell stocks, bonds, and other securities. There are several types of brokerage accounts, including:

- Online Brokerage Accounts: These accounts are managed online and offer low fees and easy access to the market.

- Full-Service Brokerage Accounts: These accounts offer personalized advice and services, but they come with higher fees.

- Robo-Advisors: These are automated investment platforms that provide advice based on your risk tolerance and investment goals.

When choosing a brokerage account, consider factors such as fees, ease of use, and available investment options.

2. Research and Analyze Stocks

Once you have opened a brokerage account, the next step is to research and analyze stocks. This involves:

- Identifying Your Investment Goals: Determine what you want to achieve with your investment, such as long-term growth or short-term income.

- Analyzing Financial Statements: Review the company's financial statements, including the income statement, balance sheet, and cash flow statement.

- Evaluating the Company's Business Model: Understand the company's business model and how it generates revenue.

- Assessing the Market: Analyze the overall market conditions and the specific sector in which the company operates.

3. Place Your Order

After researching and analyzing stocks, you can place your order to buy a US stock. There are several types of orders you can place, including:

- Market Order: This order executes immediately at the current market price.

- Limit Order: This order executes at a specific price or better.

- Stop Order: This order triggers a market order when the stock reaches a certain price.

It's important to understand the differences between these order types and choose the one that best suits your investment strategy.

4. Monitor Your Investment

Once you have bought a US stock, it's important to monitor your investment. This involves:

- Reviewing Your Investment Regularly: Keep track of your investment's performance and compare it to your investment goals.

- Adjusting Your Strategy as Needed: If your investment is not performing as expected, consider adjusting your strategy or selling the stock.

- Staying Informed: Keep up-to-date with news and events that may affect the stock's price.

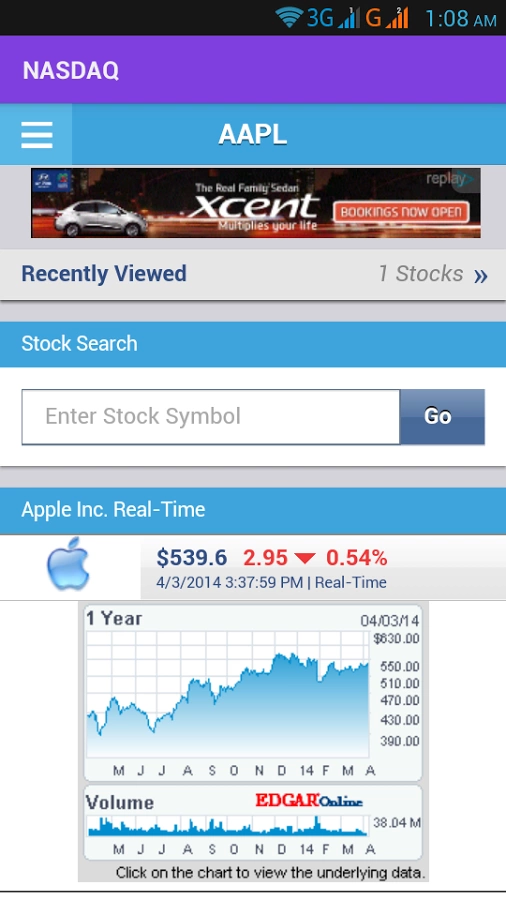

Case Study: Apple Inc. (AAPL)

Let's say you have identified Apple Inc. (AAPL) as a potential investment. After analyzing its financial statements and business model, you decide to buy 100 shares at $150 per share. You place a market order, and the trade is executed immediately.

Over the next few months, you monitor your investment and notice that the stock price has increased to

Conclusion

Buying a US stock can be a rewarding investment opportunity. By following these steps and conducting thorough research, you can make informed investment decisions. Remember to choose the right brokerage account, research and analyze stocks, place your order, and monitor your investment. Happy investing!

us stock market live