Are U.S. Stock Market Closed on Good Friday?

author:US stockS -

Understanding the Significance of Good Friday in the Stock Market

Good Friday, the day commemorating the crucifixion of Jesus Christ, is a significant religious observance for Christians worldwide. However, for investors and traders, it also raises the question of whether the U.S. stock market is closed on this day. This article delves into the details of Good Friday's impact on the stock market, providing insights into its historical background and current practices.

Historical Background

Good Friday has traditionally been a day of reflection and solemnity for Christians. In the United States, it is observed as a federal holiday, which means that most government offices, schools, and businesses are closed. However, the stock market has always been an exception to this rule.

In the past, the stock market was closed on Good Friday due to the belief that it was an inauspicious day for trading. This belief was rooted in the superstition that the market would be unpredictable and prone to volatility on this day. However, as the stock market evolved and became more professionalized, the closure on Good Friday was eventually abandoned.

Current Practices

Today, the U.S. stock market is open on Good Friday. The stock exchanges, including the New York Stock Exchange (NYSE) and the NASDAQ, operate as usual, with no interruptions in trading. This is because the market has become more regulated and sophisticated, making it less susceptible to the influence of religious beliefs.

However, it is important to note that while the stock market is open on Good Friday, trading volumes may be lower than on regular trading days. This is because many investors and traders may choose to take the day off to observe the holiday. Additionally, some brokerage firms may have their own policies regarding trading on Good Friday, which could affect individual investors.

Impact on Market Movements

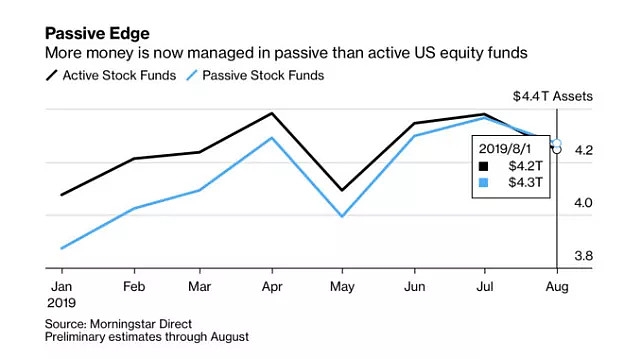

Despite the stock market being open on Good Friday, the day is often marked by lower trading volumes and volatility. This is because many investors and traders are not actively participating in the market. However, it is not uncommon for the market to experience sudden movements or reversals on Good Friday, as there may be less liquidity in the market.

In some cases, the market may also be influenced by news events or economic data releases that occur on Good Friday. For example, if there is a significant economic announcement or a major corporate event, it could have an impact on market movements.

Case Studies

One notable case involving the stock market on Good Friday was in 2010. On April 2, 2010, the stock market experienced a sudden and dramatic decline, known as the "Flash Crash." This event occurred on a Friday, and while it was not directly related to Good Friday, it highlighted the potential for volatility on days when trading volumes are lower.

Another example is the 2008 financial crisis, which began in September and continued into October. During this period, the stock market experienced significant volatility, and Good Friday was no exception. Despite the market being open, trading volumes were lower, and the market was susceptible to sudden movements.

Conclusion

In conclusion, the U.S. stock market is open on Good Friday, although trading volumes may be lower than on regular trading days. While the market has become more professionalized and less influenced by religious beliefs, it is still important for investors and traders to be aware of the potential for volatility on this day. By understanding the historical background and current practices, investors can make informed decisions about their trading activities on Good Friday.

us stock market live