Current US Stock Market Overview: June 2025

author:US stockS -

As we delve into the second half of 2025, the US stock market continues to captivate investors with its dynamic shifts and promising opportunities. In this comprehensive overview, we'll examine the key trends, market performance, and potential areas of growth that are shaping the US stock market landscape this June.

Market Performance

The US stock market has experienced a rollercoaster ride over the past few years, with several factors influencing its performance. As of June 2025, the S&P 500 index has seen a steady increase, driven by strong corporate earnings and a recovering economy. The NASDAQ, on the other hand, has been volatile, with technology stocks leading the way but facing challenges from rising interest rates and regulatory scrutiny.

Key Trends

Technology Stocks: Despite the regulatory challenges, technology stocks remain a major force in the US stock market. Companies like Apple, Microsoft, and Amazon continue to dominate the market, with their innovative products and services driving growth.

Energy Sector: The energy sector has seen a significant rebound, with oil prices reaching new highs. This surge is attributed to the global energy crisis and increasing demand for fossil fuels.

Healthcare: The healthcare sector has been a steady performer, with pharmaceutical companies and biotech firms leading the way. Advances in medical technology and an aging population are driving growth in this sector.

Real Estate: The real estate market has been recovering slowly, with demand for rental properties increasing. This trend is expected to continue, especially in urban areas.

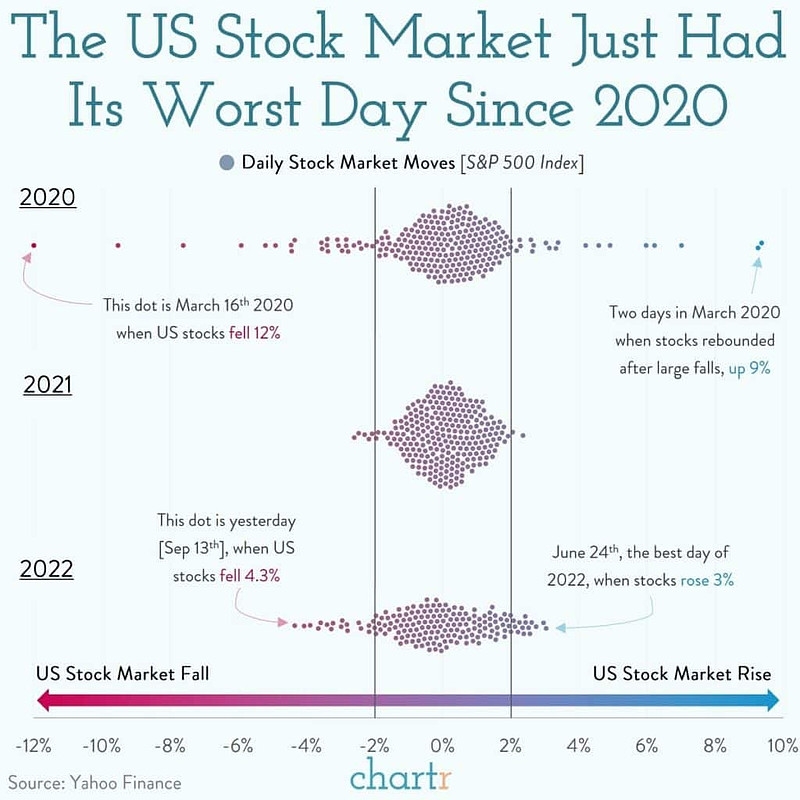

Market Volatility

The US stock market has been characterized by high volatility in recent months. This volatility can be attributed to several factors, including:

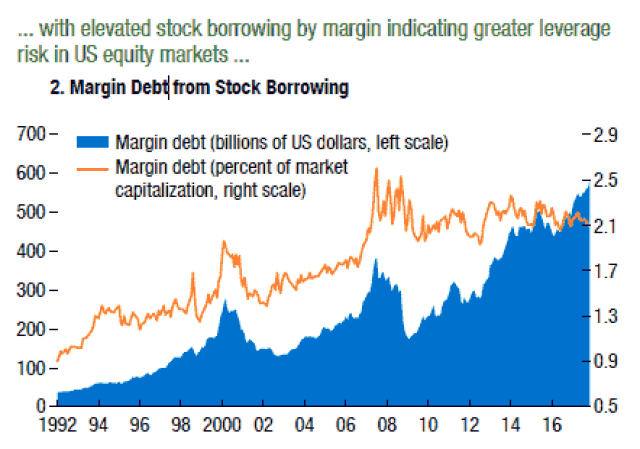

Rising Interest Rates: The Federal Reserve has been raising interest rates to combat inflation, which has caused uncertainty in the market.

Global Economic Uncertainty: Geopolitical tensions and economic slowdowns in other parts of the world have contributed to market volatility.

Corporate Earnings: Despite strong earnings reports, some companies have been unable to meet investor expectations, leading to stock price fluctuations.

Case Studies

Tesla: Tesla has been a major player in the technology sector, with its electric vehicles and renewable energy products. Despite facing regulatory challenges and competition, Tesla has continued to grow, with its stock price reaching new highs.

Exxon Mobil: Exxon Mobil has been a leader in the energy sector, with its strong performance driven by rising oil prices. The company has also been investing in renewable energy, positioning itself for future growth.

Pfizer: Pfizer has been a standout in the healthcare sector, with its successful COVID-19 vaccine and pipeline of new drugs. The company's strong financial performance has helped drive its stock price higher.

Conclusion

The US stock market in June 2025 presents a mix of opportunities and challenges. While technology and energy stocks remain strong, the market is also facing volatility and uncertainty. Investors should stay informed and consider diversifying their portfolios to mitigate risks. As always, it's important to consult with a financial advisor before making any investment decisions.

us stock market live