Nasdaq Drop: Understanding the Recent Market Decline

author:US stockS -

The Nasdaq has been a key indicator of the health of the tech industry, and its recent drop has caused quite a stir among investors and market analysts. This article aims to delve into the reasons behind the Nasdaq drop, its implications for the tech sector, and what it means for investors.

What Caused the Nasdaq Drop?

Several factors have contributed to the recent decline in the Nasdaq. One of the primary reasons is the interest rate hike by the Federal Reserve. As the Fed raises interest rates to combat inflation, it becomes more expensive for companies to borrow money, which can lead to a decrease in their stock prices.

In addition, the COVID-19 pandemic has had a lasting impact on the market. While the pandemic initially caused a surge in tech stocks due to increased demand for technology, the subsequent economic recovery has led to a shift in investor sentiment. Many investors are now focusing on value stocks, which have been underperforming compared to growth stocks.

Implications for the Tech Sector

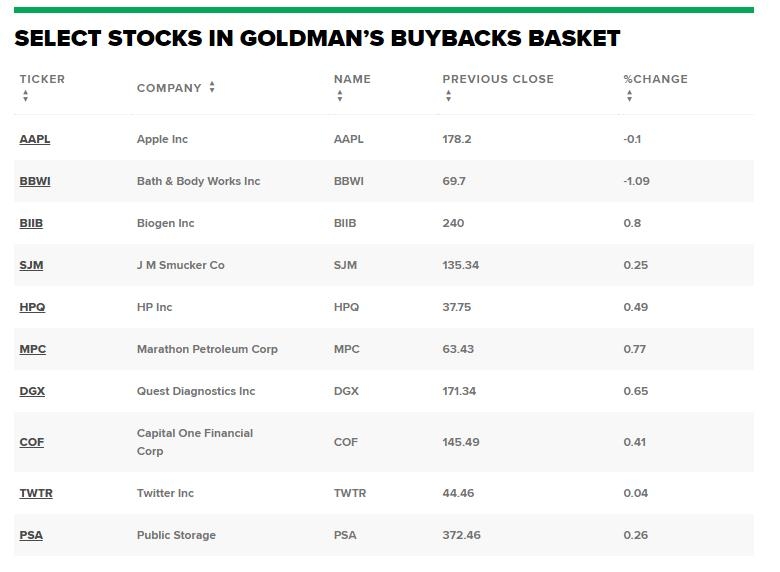

The Nasdaq drop has had a significant impact on the tech sector. Many tech giants, such as Apple, Microsoft, and Amazon, have seen their stock prices decline. This decline is not just limited to large companies; smaller tech startups have also been affected.

The Nasdaq drop highlights the volatility of the tech sector. While technology has been a major driver of economic growth in recent years, it is also subject to rapid changes and shifts in investor sentiment.

What Does It Mean for Investors?

For investors, the Nasdaq drop presents both opportunities and risks. Those who are invested in tech stocks may see their portfolios decline, but this could also be an opportunity to buy stocks at a lower price. Investors who are looking to enter the market may find that the current valuations are more attractive.

However, it is important for investors to conduct thorough research before making any investment decisions. The Nasdaq drop is a reminder that the stock market can be unpredictable, and it is crucial to stay informed and make informed decisions.

Case Study: Tesla

One of the most notable examples of the Nasdaq drop's impact on the tech sector is the case of Tesla. The electric vehicle manufacturer's stock has seen significant volatility in recent months, with a notable drop following the release of its earnings report. This highlights the sensitivity of tech stocks to market conditions and investor sentiment.

Conclusion

The Nasdaq drop is a complex issue with several contributing factors. Understanding the reasons behind the decline and its implications for the tech sector and investors is crucial for anyone looking to navigate the current market conditions. While the Nasdaq drop may be a cause for concern, it also presents opportunities for those who are willing to do their research and make informed decisions.

us stock market live