US Stock Market: Last Warning Overvaluation

author:US stockS -

The US stock market has been on a remarkable run for years, but there's a growing consensus that it may be reaching its peak. Investors are being warned about the potential overvaluation of stocks, and it's crucial to understand the implications of this warning. In this article, we'll delve into the reasons behind the overvaluation, the risks it poses, and what investors should consider moving forward.

Understanding Overvaluation

Overvaluation refers to a situation where the price of a stock or a group of stocks is higher than its intrinsic value. This can happen due to various factors, including excessive optimism, speculative buying, or a lack of fundamental analysis. When stocks are overvalued, they are more likely to experience a correction or a bear market.

Reasons for Overvaluation

Several factors have contributed to the overvaluation of US stocks:

- Low Interest Rates: The Federal Reserve's low-interest-rate policy has driven investors to seek higher returns in the stock market, pushing stock prices higher.

- Economic Recovery: The strong economic recovery following the COVID-19 pandemic has boosted corporate earnings and, in turn, stock prices.

- Speculative Buying: Some investors have been driven by speculative fervor, leading to excessive buying and pushing stock prices higher.

Risks of Overvaluation

The risks of overvaluation are significant and can have a severe impact on investors:

- Market Correction: Overvalued stocks are more likely to experience a correction, leading to significant losses for investors.

- Bear Market: An overvalued market can eventually lead to a bear market, where stock prices decline significantly.

- Economic Downturn: An overvalued market can exacerbate the impact of an economic downturn, leading to further losses for investors.

What Investors Should Do

Investors need to be cautious and consider the following steps:

- Diversify Your Portfolio: Diversification can help mitigate the risk of a market correction or bear market.

- Focus on Fundamental Analysis: Focus on companies with strong fundamentals and a sustainable business model.

- Avoid Speculative Stocks: Stay away from stocks that are overvalued and lack a solid business foundation.

- Review Your Portfolio Regularly: Regularly review your portfolio to ensure it aligns with your investment goals and risk tolerance.

Case Studies

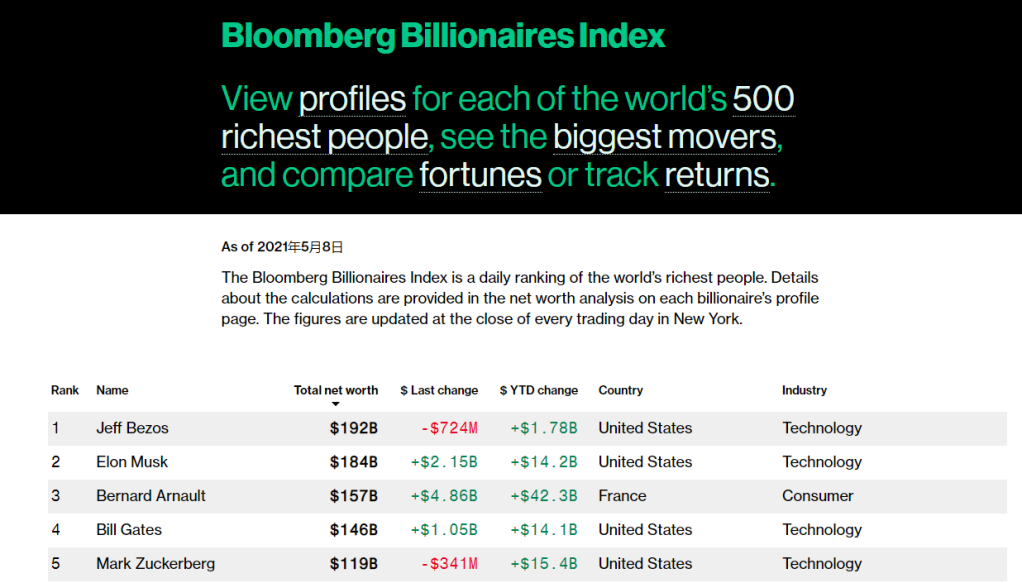

Several high-profile companies have been flagged as overvalued in recent years:

- Facebook (now Meta): The company's stock has been criticized for being overvalued due to concerns about its business model and user growth.

- Tesla: Tesla's stock has experienced significant volatility, with some analysts arguing that it is overvalued given its high price-to-earnings ratio.

- Amazon: Amazon's stock has been a target of criticism for being overvalued, despite its impressive revenue growth.

In conclusion, the US stock market is facing a last warning overvaluation. Investors need to be cautious and take steps to mitigate the risks associated with overvalued stocks. By focusing on fundamental analysis, diversifying their portfolios, and avoiding speculative stocks, investors can protect their investments and navigate the potential market corrections ahead.

dow and nasdaq today