Stocks to Buy in the US: Top Picks for 2023

author:US stockS -

Are you looking to invest in the US stock market but unsure where to start? With thousands of companies listed on major exchanges, finding the right stocks can be overwhelming. In this article, we will explore some of the best stocks to buy in the US for 2023, taking into account market trends, financial health, and growth potential.

1. Technology Stocks

The technology sector has always been a hotbed for investment opportunities. With advancements in artificial intelligence, cloud computing, and 5G technology, there are several tech stocks worth considering.

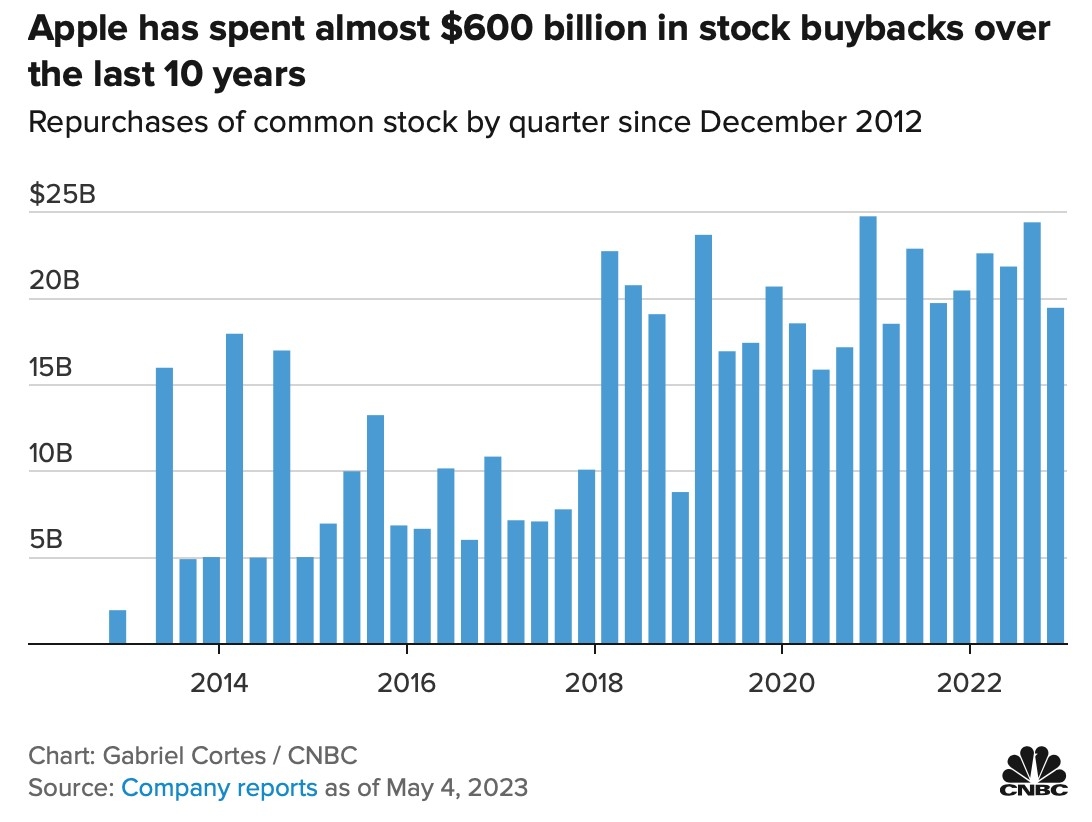

- Apple Inc. (AAPL): As the world's largest company by market capitalization, Apple has a strong presence in consumer electronics, services, and software. Its diverse product line and loyal customer base make it a stable investment.

- Amazon.com Inc. (AMZN): The e-commerce giant continues to dominate the online retail market and expand into new areas such as cloud computing and healthcare.

- Microsoft Corporation (MSFT): With its strong position in the software industry, Microsoft has a diverse portfolio of products and services, including Office 365, Azure, and LinkedIn.

2. Healthcare Stocks

The healthcare sector is another area with significant growth potential. With an aging population and advancements in medical technology, these stocks could be worth considering.

- Johnson & Johnson (JNJ): As one of the largest healthcare companies in the world, Johnson & Johnson offers a wide range of products and services, including pharmaceuticals, medical devices, and consumer healthcare products.

- Merck & Co., Inc. (MRK): A leader in the pharmaceutical industry, Merck has a strong pipeline of new drugs and a diverse portfolio of products.

- Biogen Inc. (BIIB): With a focus on neurological diseases, Biogen has several successful drugs on the market and a promising pipeline of new treatments.

3. Energy Stocks

The energy sector has seen a significant shift in recent years, with a growing focus on renewable energy sources. As the world moves towards sustainability, these stocks could offer long-term growth opportunities.

- Tesla, Inc. (TSLA): The electric vehicle (EV) manufacturer has revolutionized the automotive industry and is leading the charge towards a sustainable future.

- NVIDIA Corporation (NVDA): As a leader in graphics processing units (GPUs), NVIDIA is well-positioned to benefit from the growing demand for AI and data center technologies.

- First Solar, Inc. (FSLR): A leading manufacturer of solar panels, First Solar is well-positioned to benefit from the global shift towards renewable energy.

4. Consumer Discretionary Stocks

The consumer discretionary sector includes companies that produce non-essential goods and services, such as luxury goods, entertainment, and travel. With the economy recovering from the pandemic, these stocks could see significant growth.

- Disney (DIS): As a leader in the entertainment industry, Disney has a diverse portfolio of products and services, including theme parks, streaming services, and movies.

- Nike, Inc. (NKE): The athletic footwear and apparel company has a strong brand and a loyal customer base, making it a stable investment.

- Walmart Inc. (WMT): As the world's largest retailer, Walmart has a strong presence in the consumer discretionary sector and is well-positioned to benefit from the global shift towards online shopping.

When investing in the US stock market, it's important to do your research and consider your risk tolerance. The stocks mentioned in this article are just a starting point, and it's essential to consult with a financial advisor before making any investment decisions.

dow and nasdaq today