Title: US Rebuffs Calls to Close Stock Market

author:US stockS -

In the wake of recent global economic turmoil, calls to shut down the US stock market have been gaining traction. However, the US government and financial authorities have rebuffed these demands, emphasizing the importance of maintaining market stability. This article delves into the reasons behind the US's stance and the implications of their decision.

The stock market serves as a crucial indicator of the overall health of the economy. It reflects investor confidence and predicts future trends. In times of economic uncertainty, some argue that shutting down the market is necessary to prevent panic and protect investors. However, the US government has steadfastly refused to comply with these calls, opting instead to implement other measures to ensure market stability.

One of the primary reasons the US rebuffs calls to close the stock market is to avoid causing panic. Panic can lead to widespread selling, further driving down stock prices and causing more economic damage. By maintaining the market, the US government aims to instill confidence in investors and prevent a downward spiral.

Furthermore, closing the stock market could disrupt the entire financial system. Many businesses and individuals rely on the stock market for various financial transactions, such as retirement accounts and mortgages. If the market were to be closed, these transactions would be put on hold, potentially causing significant economic damage.

An example of the impact a market shutdown could have is seen in the aftermath of the 2008 financial crisis. When the market was shut down temporarily, it caused widespread panic and led to a significant loss of confidence in the financial system. As a result, the government had to implement numerous bailouts and stimulus packages to stabilize the economy.

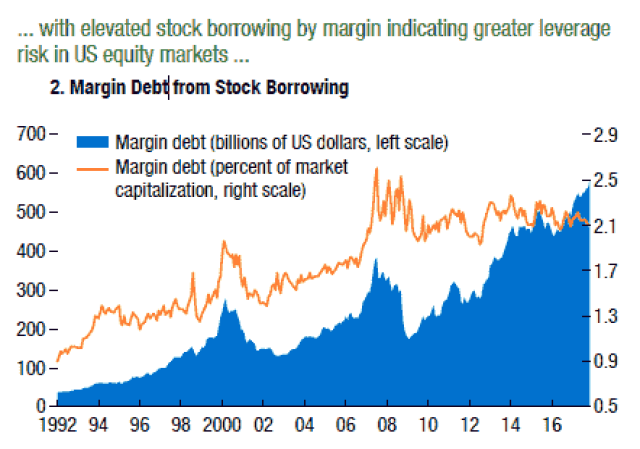

The US government has also highlighted the importance of maintaining liquidity in the financial system. A closed stock market would reduce liquidity, making it difficult for businesses and investors to access the funds they need. This could lead to a halt in economic activity, further exacerbating the current economic turmoil.

In response to calls for a market shutdown, the US government and financial authorities have implemented various measures to ensure market stability. These include providing emergency lending facilities, lowering interest rates, and implementing strict regulatory oversight.

The decision to rebuff calls to close the stock market is a bold move by the US government, one that reflects their commitment to protecting the financial system and the economy. While some argue that this decision may be too risky, others believe it is necessary to prevent further economic damage.

In conclusion, the US government's decision to rebuff calls to close the stock market is based on several key reasons. Maintaining market stability, avoiding panic, and preserving liquidity in the financial system are crucial in these uncertain times. While the future remains uncertain, the US government's commitment to protecting the economy is clear.

dow and nasdaq today