US Investors Grow Cautious Despite Stock Market Highs

author:US stockS -

In the wake of a record-breaking stock market, a sense of cautious optimism prevails among American investors. Despite the high valuations, many are hesitant to jump in, worried about the potential for a market correction. This article delves into the reasons behind this cautious approach and explores the key factors influencing investor sentiment.

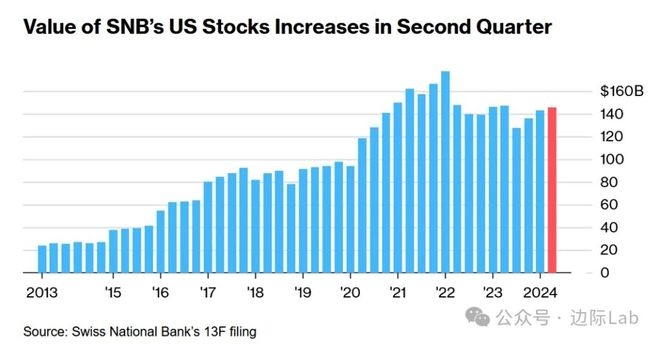

Market Performance and High Valuations

The U.S. stock market has seen significant growth in recent years, with the S&P 500 hitting new all-time highs. This has been driven by a strong economy, low unemployment, and favorable corporate earnings. However, this growth has also led to higher valuations, raising concerns about the market's sustainability.

Economic Factors

Several economic factors are contributing to the cautious stance of investors. Rising inflation, trade tensions, and the possibility of a U.S. recession are some of the key concerns. The Federal Reserve's interest rate hikes have also played a role, as higher rates can slow economic growth and impact corporate profits.

Trade Tensions

Trade tensions between the U.S. and other major economies, such as China, have added to the uncertainty. These tensions have raised concerns about the potential for a global trade war, which could have a negative impact on the global economy and, consequently, the stock market.

Market Sentiment and Behavioral Factors

Investor sentiment plays a crucial role in determining market trends. The current cautious approach is a result of a combination of fear of missing out (FOMO) and fear of a market correction. Many investors are concerned that the market has become overvalued and are hesitant to invest.

Case Studies

To illustrate the cautious approach, let's consider two case studies:

Tech Giant Apple: Despite being one of the most valuable companies in the world, Apple's stock has seen significant volatility. This is due to concerns about slowing global demand for its products and the potential impact of trade tensions on its supply chain.

Retail Giant Walmart: Walmart has faced challenges due to the rise of e-commerce and changing consumer preferences. While the company has made efforts to adapt, investors remain cautious due to these ongoing concerns.

Conclusion

In conclusion, while the U.S. stock market has reached new highs, investor sentiment is cautiously optimistic. The combination of economic factors, market sentiment, and behavioral factors has led to a cautious approach among investors. As the market continues to evolve, it will be interesting to see how these factors shape investor behavior and the overall performance of the stock market.

dow and nasdaq today