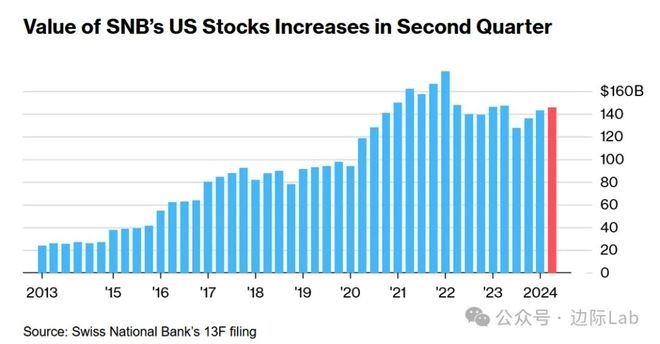

Should I Invest in US Stocks Despite Dollar Weakening in 2024?

author:US stockS -

The U.S. dollar has been experiencing a weakening trend in recent years, raising questions among investors about whether it's still wise to invest in U.S. stocks. In this article, we will explore the potential opportunities and risks of investing in U.S. stocks amidst a weakening dollar in 2024.

Understanding the Dollar's Weakening

The dollar's weakening can be attributed to various factors, including economic policies, trade imbalances, and global market dynamics. As the dollar weakens, it becomes less attractive for foreign investors, which can lead to a decrease in demand for U.S. stocks.

Opportunities Amidst a Weakening Dollar

Despite the challenges posed by a weakening dollar, there are still opportunities for investors to benefit from investing in U.S. stocks:

Dividend Yields: Many U.S. companies offer attractive dividend yields, which can provide a steady income stream for investors. As the dollar weakens, the value of these dividends may increase for foreign investors, making U.S. stocks more appealing.

Global Expansion: Many U.S. companies have expanded their operations globally, generating revenue in various currencies. As the dollar weakens, these companies may see their earnings in other currencies strengthen, potentially leading to higher overall profits.

Economic Resilience: The U.S. economy has shown remarkable resilience in recent years, even amidst global economic uncertainties. This resilience may continue to drive strong corporate earnings and support the value of U.S. stocks.

Risks to Consider

While there are opportunities, it's important to consider the risks associated with investing in U.S. stocks amidst a weakening dollar:

Inflation: A weakening dollar can lead to higher inflation, which can erode the purchasing power of investors. This can be particularly challenging for fixed-income investors.

Currency Risk: Investors who hold U.S. stocks in a foreign currency may face currency risk, as the value of their investments could decline if the dollar weakens further.

Market Volatility: A weakening dollar can lead to increased market volatility, as investors react to changing economic conditions and currency movements.

Case Study: Apple Inc.

To illustrate the potential impact of a weakening dollar on U.S. stocks, let's consider the case of Apple Inc. As a leading technology company with a significant global presence, Apple's earnings are generated in various currencies. In recent years, a weakening dollar has led to an increase in the value of Apple's earnings in other currencies, boosting its overall profitability.

Conclusion

Investing in U.S. stocks amidst a weakening dollar can be a complex decision. While there are opportunities for investors to benefit from attractive dividend yields and global expansion, it's important to carefully consider the risks associated with currency fluctuations and market volatility. By conducting thorough research and seeking professional advice, investors can make informed decisions about their investment strategies in 2024.

dow and nasdaq today