Dividend Stocks US 2021: Top Picks for Income Investors

author:US stockS -

In the ever-evolving landscape of the stock market, dividend stocks have always been a beacon for income investors seeking stability and consistent returns. As we delve into 2021, it's crucial to identify the top dividend stocks in the US that can provide investors with both income and growth potential. This article will highlight some of the best dividend stocks to consider for the year ahead.

Understanding Dividend Stocks

Before we dive into the specifics, let's clarify what dividend stocks are. Dividend stocks are shares of companies that pay out a portion of their earnings to shareholders in the form of dividends. These payments can provide investors with a steady stream of income, making them an attractive option for those looking to diversify their portfolios and secure their financial future.

Top Dividend Stocks for 2021

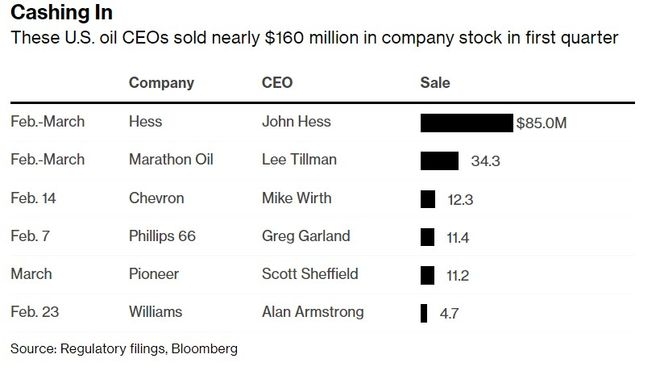

Exxon Mobil Corporation (XOM)

- Why It's a Top Pick: As one of the largest oil and gas companies in the world, Exxon Mobil has a long history of paying dividends. With a current yield of around 4.5%, it offers investors a substantial income stream.

- Case Study: In 2020, despite the challenges posed by the COVID-19 pandemic, Exxon Mobil managed to maintain its dividend payments, demonstrating its financial strength.

Johnson & Johnson (JNJ)

- Why It's a Top Pick: Johnson & Johnson is a well-established healthcare company with a strong dividend track record. With a current yield of around 2.5%, it provides investors with both income and growth potential.

- Case Study: In 2020, Johnson & Johnson's dividend increased by 5.3%, reflecting the company's commitment to rewarding shareholders.

Procter & Gamble (PG)

- Why It's a Top Pick: Procter & Gamble is a consumer goods giant with a long history of paying dividends. With a current yield of around 2.6%, it offers investors a stable income stream.

- Case Study: In 2020, Procter & Gamble's dividend increased by 4.8%, showcasing the company's commitment to shareholder value.

Microsoft Corporation (MSFT)

- Why It's a Top Pick: Microsoft is a technology powerhouse with a strong dividend track record. With a current yield of around 1.4%, it offers investors both income and growth potential.

- Case Study: In 2020, Microsoft's dividend increased by 10%, reflecting the company's financial strength and commitment to shareholder rewards.

Intel Corporation (INTC)

- Why It's a Top Pick: Intel is a leading technology company with a strong dividend track record. With a current yield of around 2.1%, it offers investors both income and growth potential.

- Case Study: In 2020, Intel's dividend increased by 10%, showcasing the company's commitment to rewarding shareholders.

Conclusion

As we navigate the complexities of the stock market, dividend stocks remain a valuable asset class for income investors. By focusing on companies with a strong dividend track record and consistent growth potential, investors can build a diversified portfolio that provides both income and long-term growth. Whether you're a seasoned investor or just starting out, these top dividend stocks for 2021 are worth considering for your investment strategy.

dow and nasdaq today