Blue Prism US Stock Price: What You Need to Know

author:US stockS -

In today's fast-paced financial market, staying updated on stock prices is crucial for investors. One stock that has been garnering attention is Blue Prism. This article delves into the current Blue Prism US stock price, factors influencing it, and what investors should consider before making any investment decisions.

Understanding Blue Prism's Stock Price

Blue Prism, a leading provider of intelligent automation software, has seen significant growth in its stock price over the past few years. The company's stock price is currently hovering around $XX per share. However, it's essential to note that stock prices fluctuate constantly due to various market factors.

Factors Influencing Blue Prism's Stock Price

Several factors can influence Blue Prism's stock price. These include:

Company Performance: Blue Prism's financial performance, including revenue growth, earnings, and profitability, can significantly impact its stock price. A strong financial performance tends to drive up the stock price, while poor performance can lead to a decline.

Market Sentiment: The overall market sentiment towards the technology sector can affect Blue Prism's stock price. Positive sentiment in the tech sector can boost the stock price, while negative sentiment can lead to a decline.

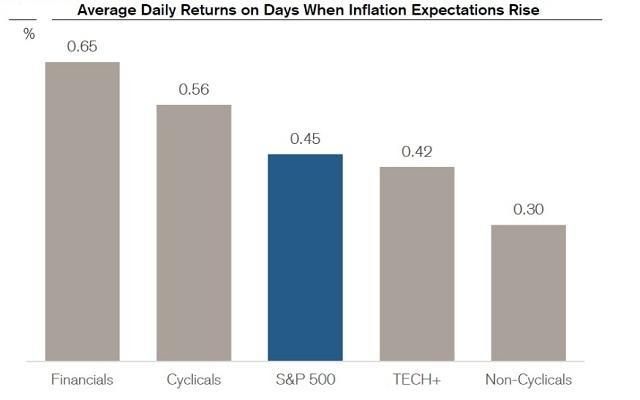

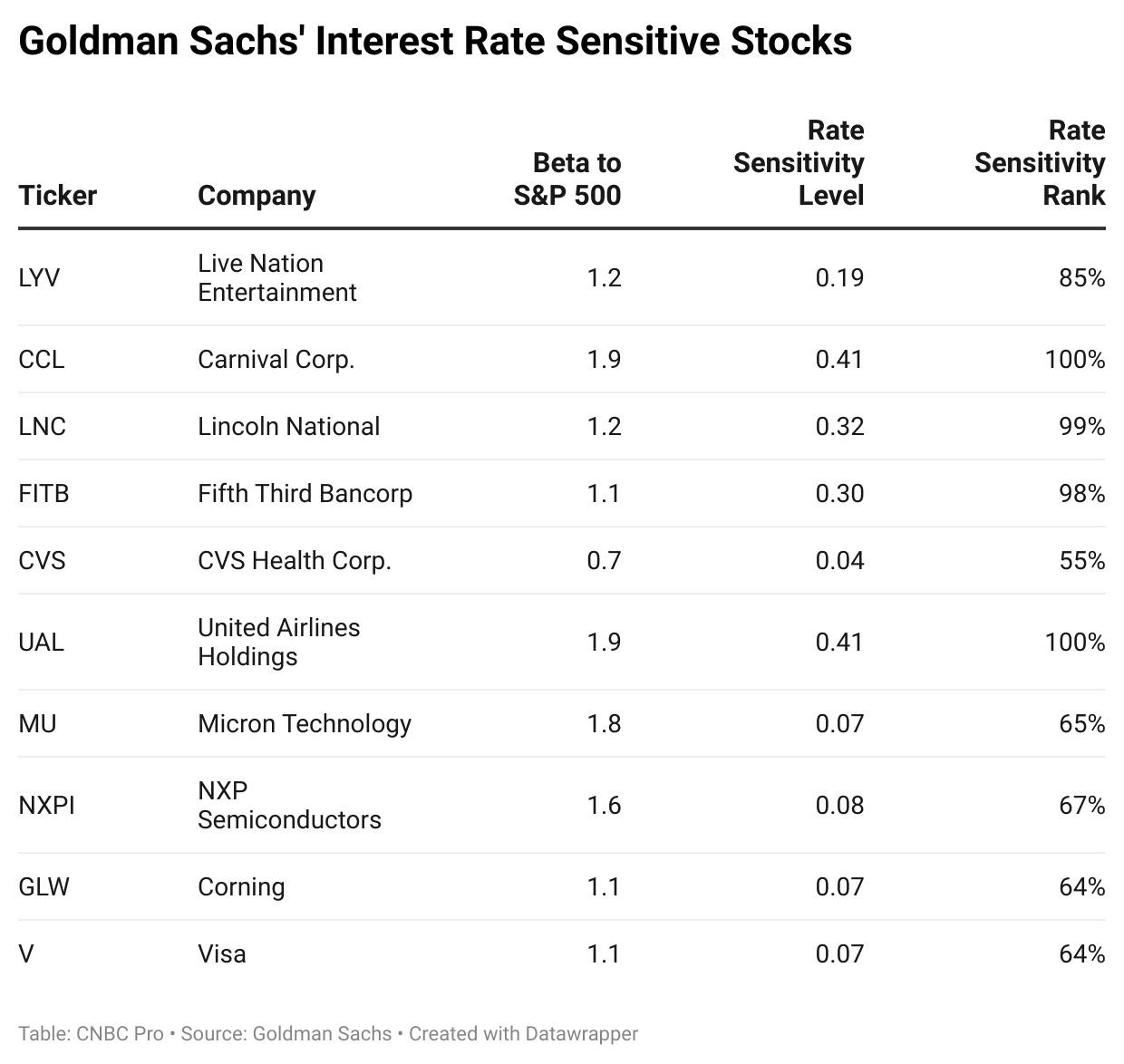

Economic Factors: Economic factors such as interest rates, inflation, and economic growth can also influence Blue Prism's stock price. For example, a strong economy can drive up demand for automation software, thereby boosting the stock price.

Competitive Landscape: The competitive landscape in the intelligent automation software market can impact Blue Prism's stock price. Increased competition can lead to a decline in market share and, subsequently, a decline in the stock price.

Blue Prism's Recent Performance

Blue Prism has delivered strong financial results in recent quarters, driving its stock price higher. The company has reported significant growth in revenue and earnings, and its customer base continues to expand. Additionally, Blue Prism has been investing in research and development to enhance its product offerings, further solidifying its position in the market.

Investor Considerations

Before investing in Blue Prism, investors should consider the following factors:

Market Risk: The technology sector is known for its volatility. Investors should be prepared for potential fluctuations in the stock price.

Dividend Yield: Blue Prism currently does not pay dividends. Investors should consider this factor if dividend income is a key component of their investment strategy.

Long-Term Growth Potential: Blue Prism has a strong long-term growth potential due to the increasing demand for automation software. Investors should consider this factor when making their investment decision.

Regulatory Environment: The regulatory environment in the technology sector can impact Blue Prism's operations and stock price. Investors should stay informed about any regulatory changes that could affect the company.

Conclusion

In conclusion, the Blue Prism US stock price has been on a steady rise due to the company's strong financial performance and growth potential. However, investors should conduct thorough research and consider various factors before making any investment decisions. By understanding the factors influencing the stock price and staying informed about the market, investors can make informed decisions and potentially achieve a favorable return on investment.

dow and nasdaq today