The Guardian US Stock Market: A Comprehensive Overview

author:US stockS -

The US stock market, known as the most influential and diverse market in the world, has always been a major concern for investors and financial experts. The Guardian US Stock Market, in particular, plays a crucial role in reflecting the economic situation of the United States. This article aims to provide a comprehensive overview of the Guardian US Stock Market, including its history, structure, and major components.

History of the Guardian US Stock Market

The Guardian US Stock Market, also known as the New York Stock Exchange (NYSE), was established in 1792. Since then, it has grown into the largest and most influential stock market in the world. It has witnessed numerous ups and downs in the past centuries, reflecting the development and changes of the global economy.

Structure of the Guardian US Stock Market

The Guardian US Stock Market is structured into two main segments: the primary market and the secondary market. The primary market is where companies issue new stocks or bonds to raise capital. Investors who participate in this market are known as initial public offering (IPO) investors. The secondary market is where investors buy and sell stocks that have already been issued. This market includes stock exchanges like the NYSE and the NASDAQ.

Major Components of the Guardian US Stock Market

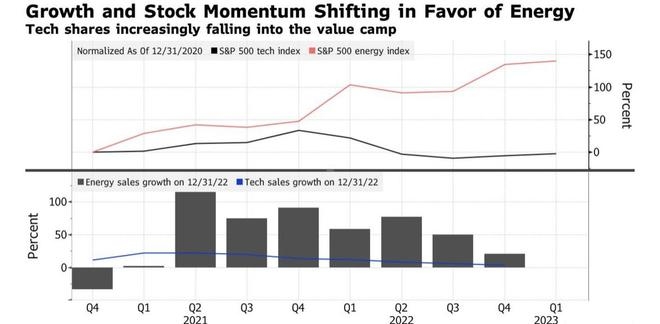

Sectors: The Guardian US Stock Market includes various sectors, such as technology, finance, healthcare, energy, and consumer goods. Each sector represents different industries and has its own unique characteristics.

Indices: The Guardian US Stock Market is represented by several indices, the most famous of which are the S&P 500, the Dow Jones Industrial Average, and the NASDAQ Composite. These indices track the performance of a specific group of companies and provide valuable information for investors.

Market Cap: Market capitalization is the total value of a company's shares. It is an important indicator for investors to evaluate a company's size and market influence.

Investing in the Guardian US Stock Market

Investing in the Guardian US Stock Market requires careful consideration of various factors, including market trends, economic indicators, and company fundamentals. Here are some tips for investors:

Diversify Your Portfolio: Diversification can help reduce risks and improve returns. Investors should consider investing in different sectors and market capitalizations.

Analyze Company Fundamentals: Before investing in a company, investors should analyze its financial statements, earnings reports, and other relevant information to evaluate its profitability and growth prospects.

Stay Informed: Keeping up with market news and economic indicators can help investors make informed decisions.

Use Professional Advice: If you are not confident in your investment skills, consider seeking advice from financial professionals.

Case Studies

To illustrate the importance of the Guardian US Stock Market, let's look at two case studies:

Apple Inc.: Since its IPO in 1980, Apple Inc. has become one of the most valuable companies in the world. Its stock has experienced significant growth over the years, making it an attractive investment for many.

Amazon.com Inc.: Amazon, established in 1994, has become the largest online retailer in the world. Its stock has also seen substantial growth, reflecting its success in the e-commerce industry.

In conclusion, the Guardian US Stock Market is a critical indicator of the economic health of the United States. By understanding its history, structure, and major components, investors can make informed decisions and potentially achieve financial success.

dow and nasdaq today