Title: US Stock Market 2023: A Comprehensive Outlook

author:US stockS -

Introduction: As we step into 2023, the US stock market is once again at the forefront of global financial attention. With a mix of optimism and cautious optimism, investors are eager to understand the trends and opportunities that lie ahead. In this article, we will delve into the key aspects of the US stock market in 2023, including market performance, sector trends, and potential investment opportunities.

Market Performance: The US stock market has shown remarkable resilience over the past few years, and 2023 is expected to be no different. The S&P 500, a widely followed benchmark index, has consistently delivered positive returns over the past decade. While there may be some volatility in the short term, the long-term outlook remains bright.

Sector Trends: Several sectors are expected to perform well in 2023. Here are some of the key trends to watch:

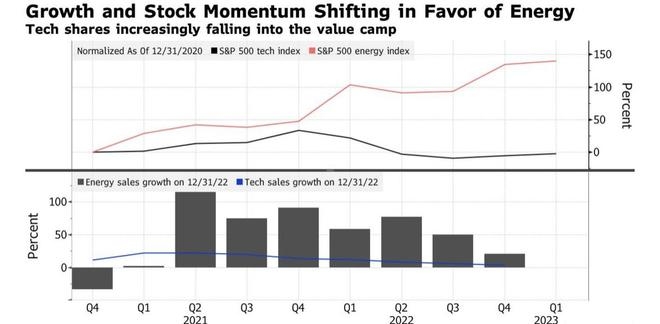

Technology: The technology sector remains a key driver of the US stock market. Companies like Apple, Microsoft, and Amazon have shown strong growth potential, and the rise of cloud computing, artificial intelligence, and 5G technology is expected to further fuel this sector's growth.

Healthcare: The healthcare sector is another area to keep an eye on. With an aging population and advancements in medical technology, healthcare companies are likely to see increased demand for their products and services.

Energy: The energy sector has experienced a significant turnaround in recent years, driven by the rise of renewable energy sources. As the world continues to shift towards cleaner energy solutions, companies in the energy sector are poised for growth.

Financials: The financial sector is expected to benefit from improving economic conditions and rising interest rates. Banks and insurance companies may see increased profitability as the economy strengthens.

Investment Opportunities: Several investment opportunities are emerging in the US stock market in 2023. Here are a few to consider:

Dividend Stocks: Dividend-paying stocks have become increasingly popular among investors seeking stable income. Companies with strong financials and a history of paying dividends are likely to be attractive options.

Growth Stocks: Growth stocks, which focus on companies with high growth potential, can be appealing for investors with a long-term perspective. It's important to conduct thorough research and analyze the company's growth prospects before investing.

International Exposure: Investing in companies with international exposure can provide diversification and potential growth opportunities. Companies with a strong global presence may benefit from expanding markets and economies.

Case Studies: To illustrate the potential of the US stock market in 2023, let's consider a few case studies:

Tesla (TSLA): As a leader in electric vehicles and renewable energy, Tesla has seen significant growth in recent years. With continued innovation and expansion, Tesla remains a strong investment opportunity in the technology sector.

Johnson & Johnson (JNJ): As a leading healthcare company, Johnson & Johnson has a diverse portfolio of products and services. With an aging population and a focus on innovation, JNJ is well-positioned for long-term growth.

Exxon Mobil (XOM): As a major player in the energy sector, Exxon Mobil has been able to adapt to the shift towards renewable energy. With a strong balance sheet and strategic investments, XOM offers potential growth and stability.

Conclusion: The US stock market in 2023 presents a mix of opportunities and challenges. By understanding market trends, sector performance, and potential investment opportunities, investors can make informed decisions. Whether you're looking for dividend stocks, growth stocks, or international exposure, the US stock market has something to offer. Stay informed, conduct thorough research, and consider seeking professional advice to navigate the dynamic market landscape.

dow and nasdaq today