Reta Us Stock Price: What You Need to Know

author:US stockS -

In the ever-evolving world of financial markets, keeping a close eye on stock prices is crucial for investors and traders alike. One stock that has caught the attention of many is Reta US. But what does the current Reta US stock price indicate, and what factors should investors consider? Let's delve into this topic and explore the key aspects that can influence the stock's value.

Understanding Reta US Stock Price

The Reta US stock price is a reflection of the company's financial health, market sentiment, and overall economic conditions. To get a clearer picture, it's essential to consider the following factors:

- Earnings Reports: Reta US's earnings reports are a critical indicator of the company's financial performance. Positive earnings reports can drive up the stock price, while negative reports can have the opposite effect.

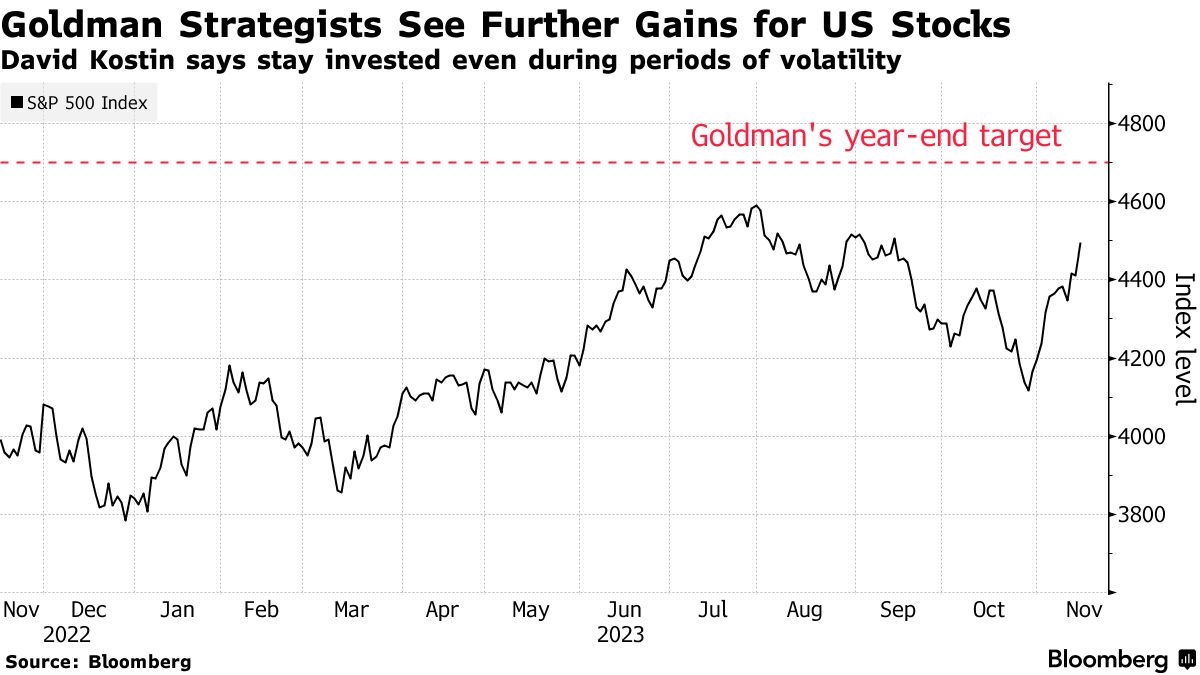

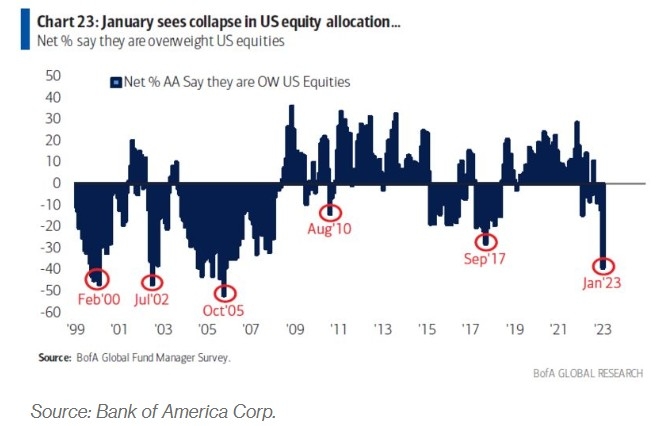

- Market Trends: The broader market trends, including economic indicators, interest rates, and geopolitical events, can significantly impact the Reta US stock price.

- Sector Performance: The performance of the sector in which Reta US operates is another crucial factor. If the sector is experiencing growth, it can positively influence the stock's value.

Analyzing Reta US Stock Price

To better understand the Reta US stock price, let's look at a few recent examples:

- Earnings Reports: In the last quarter, Reta US reported strong earnings, exceeding market expectations. This positive news led to a significant increase in the stock price.

- Market Trends: During a period of low-interest rates and strong economic growth, the Reta US stock price experienced a steady rise.

- Sector Performance: The sector in which Reta US operates has been witnessing significant growth, which has positively impacted the company's stock price.

Investment Opportunities

Given the current Reta US stock price, investors might be wondering if it presents a good opportunity. Here are a few considerations:

- Valuation: Compare the current Reta US stock price with its historical valuations and industry peers to determine if it's overvalued or undervalued.

- Dividends: If Reta US offers dividends, consider the yield and historical dividend growth.

- Growth Potential: Assess the company's growth prospects, including its expansion plans and market position.

Conclusion

The Reta US stock price is influenced by various factors, including earnings reports, market trends, and sector performance. By analyzing these factors and considering the company's valuation, dividends, and growth potential, investors can make informed decisions about their investments. Stay informed and keep an eye on the Reta US stock price to capitalize on potential opportunities.

dow and nasdaq today