How High Will the US Stock Market Go?

author:US stockS -

In recent years, the US stock market has been on a remarkable upswing, and many investors are asking, "How high will it go?" This question is particularly pertinent as the market continues to set new records. In this article, we'll delve into the factors influencing the stock market's potential trajectory and offer insights into what the future might hold.

Economic Fundamentals

One of the primary factors driving the US stock market's upward trend is the strong economic fundamentals. The United States boasts a robust economy with low unemployment rates, steady GDP growth, and a favorable business environment. These factors have contributed to the market's resilience and have encouraged investors to remain bullish.

Corporate Profits

Corporate earnings have been a key driver of the stock market's growth. Many companies have reported strong profits, leading to higher stock prices. As long as businesses continue to perform well, the stock market is likely to remain on an upward trajectory.

Low Interest Rates

The Federal Reserve has maintained low interest rates, which have been beneficial for the stock market. Low interest rates make borrowing cheaper, leading to increased investment and consumer spending. This, in turn, can drive stock prices higher.

Technological Advancements

The technology sector has been a significant contributor to the stock market's growth. Companies like Apple, Amazon, and Microsoft have seen their share prices soar, driven by their innovative products and services. The continued growth of the technology sector could propel the stock market even higher.

Global Economic Conditions

The global economic landscape is another important factor to consider. A strong global economy can boost US stocks, as companies with international operations benefit from increased demand for their products and services. Conversely, a weakening global economy could have a negative impact on the US stock market.

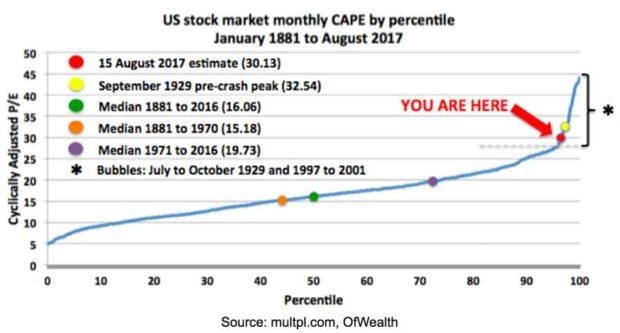

Market Valuations

While the stock market has been on a roll, it's important to consider market valuations. The S&P 500 is currently trading at a price-to-earnings (P/E) ratio of around 21, which is above its historical average. This suggests that the market may be slightly overvalued, which could lead to a correction at some point.

Case Studies

Let's take a look at a few examples of companies that have seen significant growth in the stock market:

- Apple Inc.: Since the introduction of the iPhone, Apple's share price has soared. The company's market capitalization now exceeds $2 trillion, making it the most valuable company in the world.

- Amazon.com Inc.: Amazon has become a behemoth in the e-commerce industry, with its share price increasing exponentially over the years.

- Microsoft Corporation: Microsoft has seen a remarkable turnaround since the 1990s, with its share price rising from

30 to over 200.

Conclusion

While it's impossible to predict the exact trajectory of the US stock market, it's clear that several factors are contributing to its growth. Economic fundamentals, corporate profits, low interest rates, technological advancements, and global economic conditions all play a role. As long as these factors remain in place, the stock market is likely to continue its upward trend. However, it's important to keep an eye on market valuations and be prepared for potential corrections.

dow and nasdaq today