US Citizen Selling Canadian Stock: A Comprehensive Guide

author:US stockS -

Are you a U.S. citizen looking to sell Canadian stock? If so, you're not alone. Many Americans invest in foreign markets, including Canada, for various reasons. However, navigating the complexities of international stock sales can be daunting. This article will provide you with a comprehensive guide to help you understand the process, potential tax implications, and key considerations when selling Canadian stock as a U.S. citizen.

Understanding the Basics

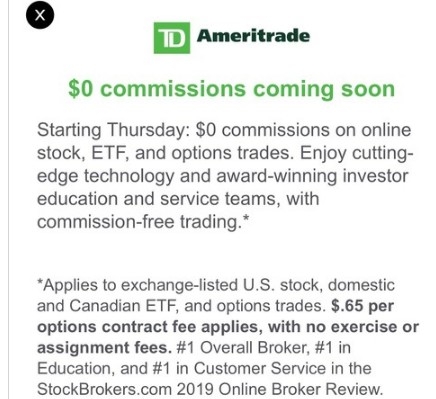

Firstly, it's important to distinguish between owning shares in a Canadian company and owning shares in a Canadian stock exchange-traded fund (ETF). If you own shares in a Canadian company, you will need to consider corporate tax withholdings and reporting requirements. On the other hand, if you own shares in a Canadian ETF, the process may be slightly different.

Corporate Tax Withholdings

When selling shares of a Canadian company, the Canadian government requires the buyer to withhold a certain percentage of the sale proceeds as tax. This withholding is based on the assumption that the seller is a non-resident of Canada. The standard withholding rate is 25%, but it may be higher depending on the specific circumstances.

Reporting Requirements

As a U.S. citizen, you are required to report your foreign investments, including Canadian stocks, on your U.S. tax return. This is typically done using Form 8938, which must be filed with your income tax return if your foreign financial assets exceed certain thresholds.

Tax Implications

The sale of Canadian stock can have significant tax implications for U.S. citizens. Here are some key points to consider:

- Capital Gains Tax: If you sell your Canadian stock at a profit, you will need to pay capital gains tax in both the U.S. and Canada. The U.S. tax rate will depend on your total income, while the Canadian tax rate will be based on the specific rules in place at the time of sale.

- Withholding Tax: As mentioned earlier, the buyer of your Canadian stock may withhold a portion of the sale proceeds as tax. This amount will be reported to the IRS and may be credited against your U.S. tax liability.

- Tax Treaty: The U.S. and Canada have a tax treaty that can potentially reduce your tax liability on the sale of Canadian stock. It's important to consult with a tax professional to understand how this treaty may apply to your situation.

Key Considerations

Before selling your Canadian stock, consider the following factors:

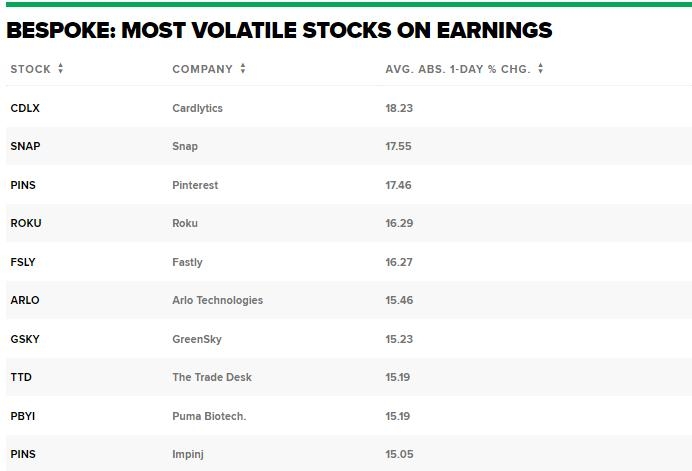

- Market Conditions: Evaluate the current market conditions and the performance of the Canadian stock you wish to sell. It's important to sell at a favorable time to maximize your returns.

- Tax Planning: Consult with a tax professional to understand the potential tax implications of selling your Canadian stock. They can help you develop a tax-efficient strategy to minimize your tax liability.

- Reporting: Ensure that you accurately report your Canadian stock sale on your U.S. tax return to avoid any penalties or interest.

Case Study: Selling Canadian ETFs

Let's consider a hypothetical scenario where a U.S. citizen owns shares in a Canadian ETF. When selling these shares, the process is similar to selling shares of a Canadian company. The buyer will withhold a portion of the sale proceeds as tax, and the seller will need to report the sale on their U.S. tax return.

In this case, the U.S. citizen may be eligible for a refund of the Canadian tax withheld if they have already paid U.S. tax on the same income. This can be claimed on Form 1116, Foreign Tax Credit.

Conclusion

Selling Canadian stock as a U.S. citizen requires careful planning and consideration of various factors. By understanding the basics, tax implications, and key considerations, you can navigate the process more effectively and minimize your tax liability. Always consult with a tax professional to ensure compliance with U.S. and Canadian tax laws.

dow and nasdaq today