How Did the US Stock Market Crash?

author:US stockS -

The US stock market crash of 1929, often referred to as the "Great Crash," was a pivotal event in American financial history. This article delves into the causes, effects, and lasting impact of this historic downturn.

Causes of the Stock Market Crash

The 1920s were a period of rapid economic growth and prosperity in the United States. However, several factors contributed to the eventual collapse of the stock market:

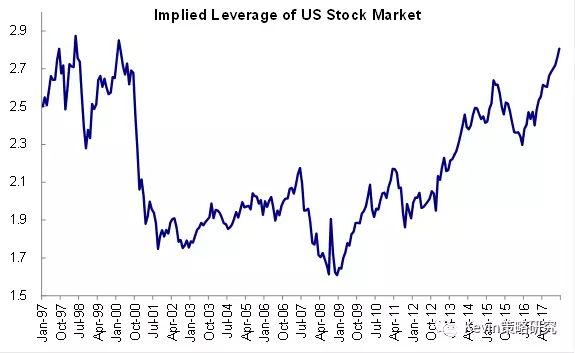

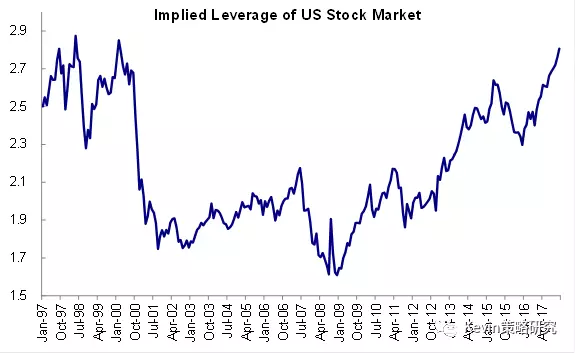

- Speculative Mania: Investors began buying stocks on margin, meaning they borrowed money to purchase shares. This led to an overvaluation of stocks, as investors were willing to pay inflated prices in the hope of selling them at a higher price.

- Excessive Credit: Banks and other financial institutions provided easy access to credit, fueling the speculative frenzy.

- Economic Imbalances: The economy was unbalanced, with overproduction and underconsumption. This imbalance was exacerbated by the Smoot-Hawley Tariff Act of 1930, which raised tariffs on imported goods, leading to a decrease in international trade.

- Lack of Regulation: The stock market was largely unregulated at the time, allowing for widespread fraud and manipulation.

The Crash of 1929

On October 24, 1929, known as "Black Thursday," the stock market opened and quickly plummeted. Investors began selling off their shares en masse, leading to a rapid decline in stock prices. The panic spread rapidly, and by the end of the day, the market had lost 12% of its value.

The panic continued throughout the following weeks, with the market losing another 30% of its value by the end of November. This period is often referred to as the "Great Crash."

Effects of the Stock Market Crash

The stock market crash had devastating effects on the American economy and society:

- Bank Failures: The crash led to a wave of bank failures, as depositors rushed to withdraw their money. This further eroded public confidence in the financial system.

- Unemployment: The crash triggered a severe economic downturn, leading to widespread unemployment. The unemployment rate reached a peak of 25% in 1933.

- Debt and Foreclosures: Many investors and homeowners were left with substantial debt and lost their homes. This led to a rise in homelessness and poverty.

- Political and Social Unrest: The economic hardships caused by the crash led to increased political and social unrest, as people demanded change and reform.

Case Study: The Bank of the United States

One notable example of the impact of the stock market crash was the failure of the Bank of the United States. This bank, one of the largest in the country, was unable to meet the demands of its depositors after the crash. The bank's failure was a catalyst for the wave of bank failures that followed, further eroding public confidence in the financial system.

Conclusion

The US stock market crash of 1929 was a monumental event that had far-reaching consequences. The crash exposed the weaknesses of the American financial system and laid the groundwork for the New Deal, a series of programs and reforms aimed at restoring economic stability and preventing future crises.

us stock market today live cha