Can I Buy Air Canada Stock in the US?

author:US stockS -

Are you looking to invest in Air Canada but unsure if you can do so from the United States? The answer is a resounding yes! In this article, we'll explore how you can purchase Air Canada stock from the US, the benefits of investing in this airline, and what you need to consider before making your investment.

Investing in Air Canada Stock: The Basics

Air Canada, the flag carrier and largest airline in Canada, is listed on the Toronto Stock Exchange (TSX) under the ticker symbol "AC." However, US investors can still purchase Air Canada stock through various means.

One way to invest in Air Canada is by using a Canadian brokerage account. Many online brokers, such as TD Ameritrade, E*TRADE, and Charles Schwab, offer access to international stocks, including those listed on the TSX. By opening a Canadian brokerage account, you can buy Air Canada stock directly from the TSX.

Benefits of Investing in Air Canada Stock

Investing in Air Canada stock offers several benefits, including:

- Strong Market Performance: Air Canada has a long history of strong financial performance, making it an attractive investment for long-term investors.

- Diversification: Investing in Air Canada provides exposure to the Canadian airline industry, which can be a valuable addition to a well-diversified portfolio.

- Potential for Growth: As one of the largest airlines in North America, Air Canada has significant growth potential, especially as the aviation industry continues to recover from the COVID-19 pandemic.

How to Buy Air Canada Stock in the US

To buy Air Canada stock from the US, follow these steps:

- Open a Canadian Brokerage Account: Choose a broker that offers access to international stocks, such as TD Ameritrade, E*TRADE, or Charles Schwab.

- Fund Your Account: Transfer funds from your US brokerage account to your new Canadian brokerage account.

- Place an Order: Once your account is funded, place an order to buy Air Canada stock using the ticker symbol "AC" on the TSX.

Considerations Before Investing

Before investing in Air Canada stock, consider the following factors:

- Currency Risk: Investing in a foreign stock means you'll be exposed to currency fluctuations. If the Canadian dollar strengthens against the US dollar, your investment may be worth less in USD.

- Regulatory Risk: Be aware of any regulatory differences between the US and Canada that may affect your investment.

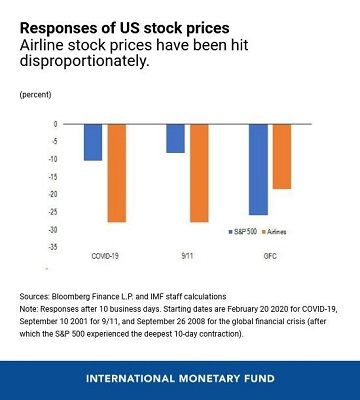

- Market Volatility: The airline industry is known for its volatility, so be prepared for potential fluctuations in Air Canada's stock price.

Case Study: Air Canada's Post-Pandemic Recovery

One example of Air Canada's resilience is its recovery from the COVID-19 pandemic. Despite facing significant challenges, the airline has implemented various cost-cutting measures and has seen a gradual increase in passenger traffic. As a result, Air Canada's stock price has shown signs of recovery, making it an attractive investment for those looking to capitalize on the aviation industry's rebound.

In conclusion, US investors can easily purchase Air Canada stock through a Canadian brokerage account. By understanding the basics and considering the potential risks, you can make an informed decision about whether Air Canada is a suitable investment for your portfolio.

us stock market today live cha