US Stock Market Live: Real-Time Insights and Analysis

author:US stockS -

The US stock market is a dynamic and ever-changing landscape that requires constant monitoring and analysis. Whether you're a seasoned investor or just starting out, staying informed about the latest market trends and news is crucial. This article will provide you with a comprehensive overview of the US stock market, including real-time insights and analysis to help you make informed decisions.

Understanding the US Stock Market

The US stock market is composed of several major exchanges, including the New York Stock Exchange (NYSE) and the NASDAQ. These exchanges offer a platform for investors to buy and sell shares of publicly-traded companies. The stock market is driven by various factors, such as economic data, corporate earnings reports, and geopolitical events.

Real-Time Market Data

One of the key benefits of the modern stock market is the availability of real-time data. Investors can access up-to-date information about stock prices, trading volumes, and market indices. This allows you to stay ahead of the curve and make timely decisions.

Key Market Indices

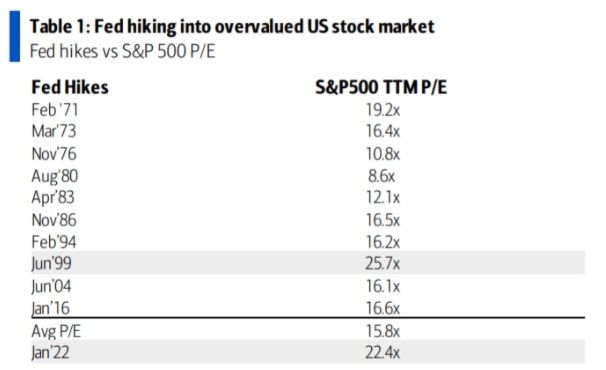

Several market indices are used to gauge the overall performance of the US stock market. The most well-known indices include the S&P 500, the Dow Jones Industrial Average, and the NASDAQ Composite. Each index has its own set of constituent companies, which can provide valuable insights into different sectors and industries.

Market Analysis and Trends

Analyzing the stock market requires a deep understanding of various factors, including economic indicators, company fundamentals, and technical analysis. By examining these elements, investors can identify trends and potential opportunities.

Economic Indicators

Economic indicators, such as GDP growth, unemployment rates, and inflation, can significantly impact the stock market. For example, higher GDP growth can indicate a strong economy, which may lead to higher stock prices. Conversely, higher unemployment rates or inflation can suggest a weakening economy, potentially causing stock prices to fall.

Company Fundamentals

Company fundamentals, such as earnings, revenue, and debt levels, are critical for evaluating a company's financial health. Investors often look for companies with strong fundamentals, as they may be more resilient to market downturns.

Technical Analysis

Technical analysis involves analyzing historical stock price and volume data to identify patterns and trends. This approach can help investors make predictions about future price movements.

Case Studies

Let's consider a recent example. In early 2020, the stock market experienced a significant downturn due to the COVID-19 pandemic. Companies in sectors like travel, leisure, and consumer discretionary were particularly hard hit. However, companies in sectors like healthcare and technology were able to maintain or even increase their stock prices. This example highlights the importance of analyzing various factors to make informed investment decisions.

Conclusion

The US stock market is a complex and ever-evolving environment. By staying informed about real-time data, market trends, and analysis, investors can make more informed decisions. Whether you're an experienced investor or just starting out, understanding the key components of the stock market is crucial for long-term success.

us stock market today