Title: US Elections and Stock Market: Understanding the Impact

author:US stockS -

Introduction: The relationship between US elections and the stock market has long been a subject of intrigue and debate among investors and financial experts. With each election cycle, the market reacts differently, sometimes positively and other times negatively. In this article, we delve into the impact of US elections on the stock market, highlighting key factors that influence these changes. By understanding these dynamics, investors can better position themselves to navigate the market during election years.

The Political Cycle and Market Dynamics

Throughout the political cycle, investors often focus on three key stages: pre-election, election day, and post-election. Each stage brings its own set of challenges and opportunities.

Pre-Election Phase: During the pre-election phase, investors closely monitor political debates, surveys, and polls. These indicators can influence market sentiment and investor behavior. For example, if a particular candidate gains momentum in the polls, it can lead to a surge in the stock market, as investors anticipate favorable policies. Conversely, negative news or unexpected events can cause the market to decline.

Case Study: During the 2016 presidential election, investors were initially optimistic about Donald Trump's win, which led to a surge in the stock market. However, as concerns about his policies and global trade tensions emerged, the market experienced significant volatility.

Election Day: On election day, the market often experiences a lull, as investors wait for the results. The day after the election can be tumultuous, as investors react to the outcome. In some cases, a surprising victory can cause the market to plummet, while a win by an expected candidate may result in a rally.

Post-Election Phase: After the election, the market tends to focus on the policy agenda of the new administration. Investors analyze the impact of potential policies on various sectors, such as healthcare, energy, and finance. This phase is often characterized by increased market volatility as investors react to the evolving political landscape.

Key Factors Influencing Stock Market during Elections

Several factors can influence the stock market during elections:

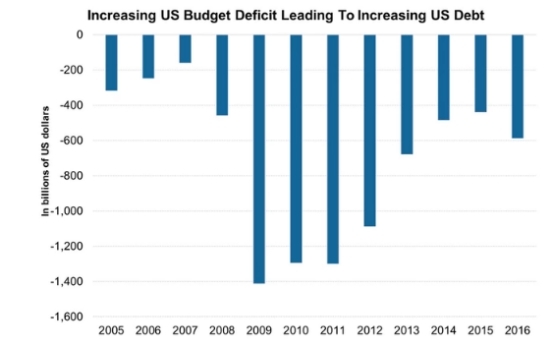

Policy Uncertainty: Political campaigns often introduce policies that can affect various sectors. Investors tend to become cautious during this period, leading to market volatility.

Market Sentiment: The mood of the market can shift based on the perceived outcome of the election. Optimism about a particular candidate or party can lead to a surge in the market, while uncertainty can cause it to decline.

Global Economic Conditions: The global economic landscape can impact the US stock market during elections. For example, if global markets are performing well, it can positively influence the US market, regardless of the election outcome.

Economic Indicators: Investors closely monitor economic indicators such as unemployment rates, GDP growth, and inflation during elections. These indicators can provide insights into the state of the economy and influence market movements.

Conclusion: The relationship between US elections and the stock market is complex and multifaceted. By understanding the key factors and stages of the political cycle, investors can better navigate the market during election years. While uncertainty is often a hallmark of election seasons, staying informed and prepared can help investors make informed decisions.

us stock market today