Total Market Capitalization: The US Stock Market Value

author:US stockS -

In the ever-evolving financial landscape, understanding the total market capitalization of the US stock market is crucial for investors, economists, and market enthusiasts. This figure represents the combined value of all publicly traded companies in the United States. In this article, we will delve into the significance of this metric, its current status, and its implications for the future.

Understanding Total Market Capitalization

The total market capitalization of the US stock market is a measure of the total value of all stocks available on the market. It is calculated by multiplying the current share price of each stock by the number of shares outstanding. This figure is often used as an indicator of the overall health and size of the stock market.

Current Status of the US Stock Market

As of the latest available data, the total market capitalization of the US stock market stands at an impressive over $35 trillion. This figure highlights the sheer size and influence of the US stock market on global financial markets. Over the past decade, the US stock market has experienced significant growth, driven by factors such as technological advancements, strong corporate earnings, and favorable economic conditions.

Implications of Total Market Capitalization

The total market capitalization of the US stock market has several implications for investors and the broader economy:

Investment Opportunities: A higher total market capitalization indicates a larger pool of potential investment opportunities. Investors can choose from a wide range of sectors and industries, allowing them to diversify their portfolios.

Economic Growth: The US stock market is often considered a barometer of economic health. A robust stock market can indicate strong economic growth and consumer confidence.

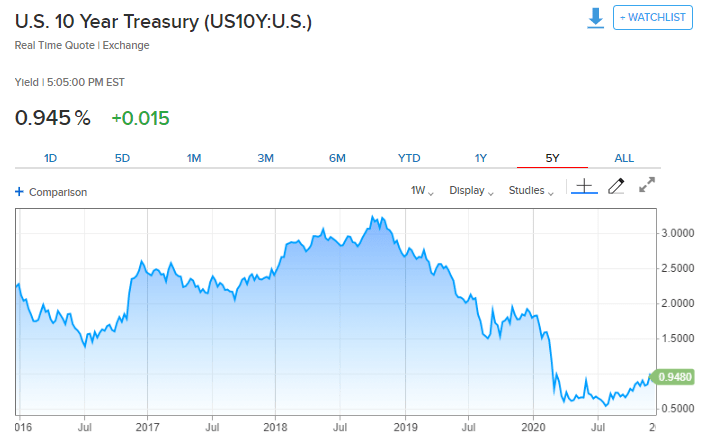

Inflation and Interest Rates: The total market capitalization can influence inflation and interest rates. Central banks often monitor stock market trends to assess the overall economic outlook.

Global Influence: The US stock market plays a significant role in global financial markets. Its performance can impact stock markets worldwide, affecting investor sentiment and economic stability.

Case Studies

To illustrate the impact of total market capitalization, let's consider a few case studies:

Tech Stocks: The technology sector has been a major driver of the US stock market's growth. Companies like Apple, Microsoft, and Amazon have seen their market capitalization soar, contributing significantly to the overall total market capitalization.

COVID-19 Pandemic: The COVID-19 pandemic caused significant volatility in the stock market. Despite the initial downturn, the US stock market recovered quickly, demonstrating its resilience and adaptability.

Economic Recovery: The total market capitalization of the US stock market has continued to grow, indicating a strong economic recovery from the pandemic.

Conclusion

The total market capitalization of the US stock market is a crucial metric that provides valuable insights into the health and size of the market. As investors and market enthusiasts, understanding this figure can help us make informed decisions and gain a better understanding of the broader economic landscape.

us stock market today