Title: Momentum Stocks High Volume US Large Cap

author:US stockS -

In the world of stock market investments, large-cap companies have always been a popular choice for investors. These companies are known for their stability, size, and strong financial performance. However, with the rise of momentum trading, many investors are now turning to high-volume momentum stocks, particularly in the US large-cap sector. This article will delve into the concept of momentum stocks, their significance in the large-cap space, and why they are becoming increasingly popular among investors.

What are Momentum Stocks?

Momentum stocks are shares of companies that have shown a consistent increase in price over a short period. These stocks are often associated with strong growth potential and are often bought by investors looking to capitalize on the upward trend. The key factor that drives momentum stocks is the belief that the stock's price will continue to rise.

High Volume in US Large Cap Stocks

The US large-cap market is home to some of the biggest and most well-known companies in the world. These companies, such as Apple, Microsoft, and Google, are known for their stability and strong financial performance. However, with the rise of momentum trading, these large-cap stocks are now experiencing high trading volumes.

Why are Momentum Stocks High Volume in the US Large Cap Sector?

There are several reasons why momentum stocks are high volume in the US large-cap sector:

- Strong Financial Performance: Large-cap companies often have strong financial performance, which attracts investors looking to capitalize on their upward trend.

- Liquidity: Large-cap stocks are highly liquid, making it easier for investors to buy and sell these stocks without impacting their price.

- Institutional Support: Many large-cap companies are supported by institutional investors, such as mutual funds and pension funds, which can drive trading volumes.

- Momentum Trading: Investors who follow momentum trading strategies are often looking to buy high and sell high, which can drive trading volumes in these stocks.

Case Studies:

To illustrate the concept of momentum stocks in the US large-cap sector, let's take a look at a few case studies:

- Apple Inc. (AAPL): Apple is a prime example of a high-volume momentum stock in the US large-cap sector. Over the past few years, the company has seen significant growth, driven by its strong financial performance and innovation. As a result, trading volumes have been consistently high.

- Microsoft Corporation (MSFT): Similar to Apple, Microsoft has seen strong growth and high trading volumes. The company's focus on cloud computing and software development has been a key driver of its momentum.

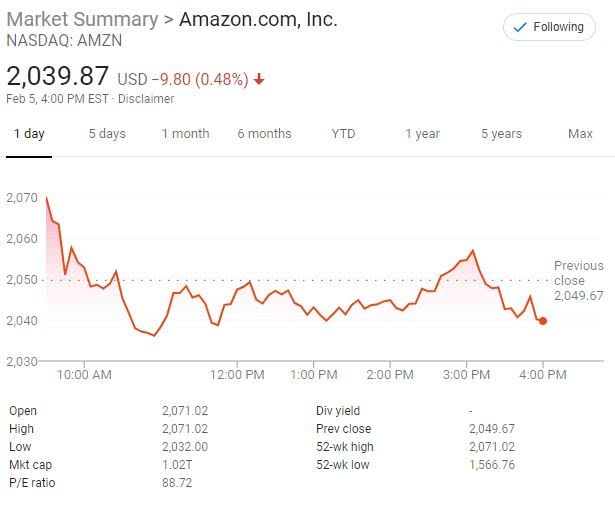

- Amazon.com Inc. (AMZN): Amazon is another high-volume momentum stock in the US large-cap sector. The company's growth in e-commerce and cloud computing has driven significant trading volumes.

Conclusion

Momentum stocks in the US large-cap sector have become increasingly popular among investors due to their strong financial performance, liquidity, and institutional support. By understanding the concept of momentum stocks and their significance in the large-cap space, investors can make informed decisions and potentially capitalize on the upward trends of these high-volume stocks.

us stock market today