Can I Buy US Stocks in My Canadian TFSA?

author:US stockS -

Investing in U.S. stocks can be a lucrative opportunity for Canadians, especially when it comes to their Tax-Free Savings Accounts (TFSA). The question of whether you can buy U.S. stocks within your Canadian TFSA is a common one. The good news is that the answer is a resounding yes. Here’s everything you need to know about investing in U.S. stocks within your TFSA.

Understanding Your TFSA

A TFSA is a registered account that allows Canadians to invest and grow money tax-free. The annual contribution limit varies each year and is indexed to inflation. As of 2021, the annual contribution limit is $6,000. Contributions you make to your TFSA grow tax-free and any earnings or capital gains are not taxed when withdrawn.

Buying U.S. Stocks in Your TFSA

Yes, you can buy U.S. stocks in your TFSA. There are a few ways to do this:

Through a Canadian brokerage firm: Most Canadian brokerage firms offer access to U.S. stocks. You simply need to open an account with a firm that provides access to U.S. markets and then you can purchase U.S. stocks just as you would Canadian stocks.

Using a U.S.-based brokerage account: While less common, you can open a brokerage account with a U.S. firm and buy U.S. stocks. This option may be beneficial if you have substantial U.S. investments and prefer a single platform for all your investments.

Important Considerations

1. Currency Conversion: When buying U.S. stocks, you need to be aware of currency conversion fees. Some brokers charge a premium for converting CAD to USD, so it’s important to compare fees.

2. Exchange Rate Fluctuations: Fluctuations in the exchange rate can affect the value of your investments. While this can be a risk, it’s also an opportunity for growth if the Canadian dollar strengthens against the U.S. dollar.

3. Tax Implications: Since your TFSA is a Canadian account, any U.S. dividends received from your U.S. stocks will be taxed at the time of withdrawal. However, if you hold the stock for the required holding period, the dividend tax credit may reduce the tax liability.

4. Dividends and Capital Gains Tax: U.S. stocks can offer higher dividend yields compared to Canadian stocks, but it’s important to understand the tax implications of dividends and capital gains.

Case Study: Dividend Stocks

Let’s say you purchase

Conclusion

Investing in U.S. stocks in your Canadian TFSA is a viable and potentially profitable option. However, it’s crucial to understand the risks and tax implications associated with such investments. As with any investment, it’s important to do thorough research and consider consulting with a financial advisor before making any decisions.

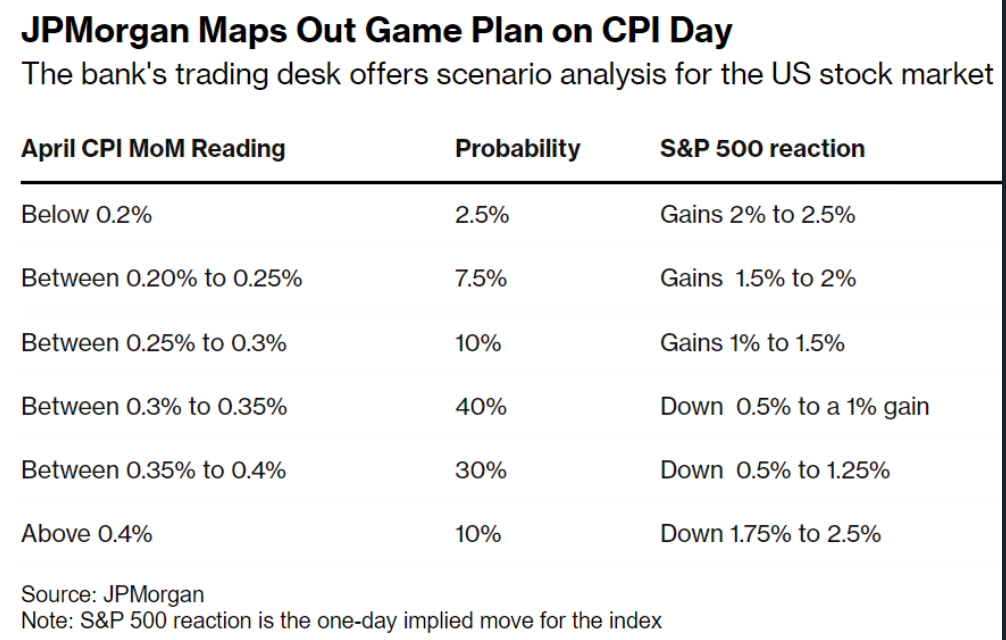

us stock market today