Lithium Battery Stocks in the US: A Comprehensive Guide

author:US stockS -

In the ever-evolving landscape of technology, the demand for lithium batteries has surged. As the world becomes more reliant on renewable energy sources and portable electronics, the importance of lithium battery stocks in the US cannot be overstated. This article delves into the key players, market trends, and potential investments within this dynamic sector.

Understanding Lithium Battery Stocks

Lithium battery stocks refer to shares of companies involved in the production, development, and distribution of lithium-ion batteries. These batteries are crucial for various applications, including electric vehicles (EVs), renewable energy storage, and portable electronics. With the increasing global emphasis on sustainability and technological advancement, the demand for lithium batteries has skyrocketed.

Market Trends in the US Lithium Battery Industry

The US lithium battery market is witnessing a remarkable growth trajectory. Several factors contribute to this upward trend:

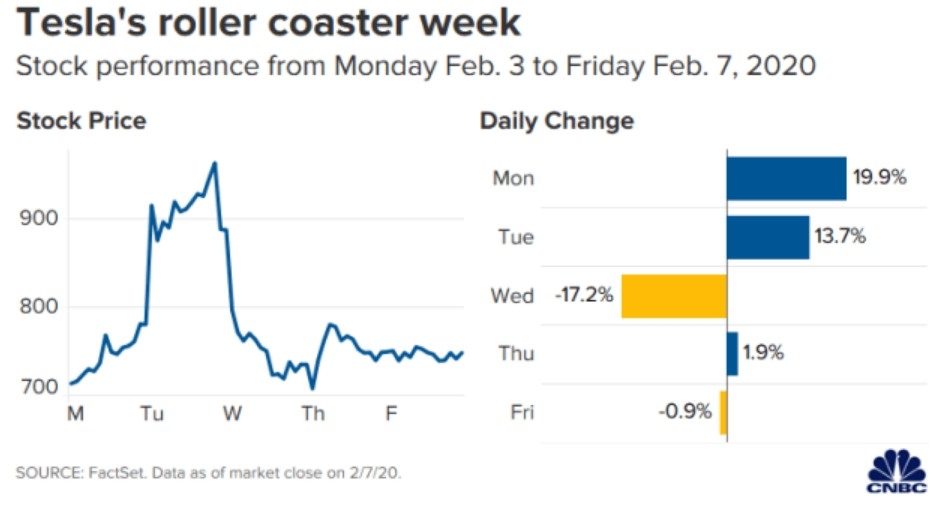

- Rising Demand for Electric Vehicles: The US government's push for electric vehicles has significantly increased the demand for lithium batteries. Companies like Tesla and General Motors are leading the charge, driving the need for robust battery solutions.

- Renewable Energy Storage: As the US transitions to cleaner energy sources, lithium batteries play a crucial role in storing solar and wind energy. This has opened up new opportunities for battery manufacturers and suppliers.

- Portable Electronics: The ever-growing consumer demand for smartphones, tablets, and other portable devices has also fueled the lithium battery market.

Key Players in the US Lithium Battery Industry

Several companies have emerged as key players in the US lithium battery industry. Here are some notable examples:

- Tesla: As the leading manufacturer of electric vehicles, Tesla is a dominant force in the lithium battery market. The company's Gigafactory in Nevada is one of the largest lithium-ion battery production facilities in the world.

- LG Chem: This South Korean company is a leading supplier of lithium batteries for various applications, including EVs and portable electronics.

- Panasonic: Panasonic is a major player in the lithium battery market, providing batteries for a wide range of applications, including EVs and renewable energy storage.

Investing in Lithium Battery Stocks

Investing in lithium battery stocks can be a lucrative opportunity, but it's essential to conduct thorough research. Here are some tips for potential investors:

- Analyze Company Financials: Evaluate the financial health of the companies you're considering investing in. Look for signs of strong revenue growth, profitability, and a solid balance sheet.

- Understand Market Trends: Stay informed about the latest market trends and regulatory changes that could impact the lithium battery industry.

- Diversify Your Portfolio: Consider diversifying your investments across different companies and sectors within the lithium battery industry to mitigate risk.

Case Study: Tesla's Lithium Battery Strategy

Tesla's lithium battery strategy is a prime example of how companies can leverage the growing demand for lithium batteries. By investing heavily in battery production and establishing partnerships with key suppliers, Tesla has positioned itself as a leader in the EV market. The company's Gigafactory has significantly reduced battery costs and improved production capacity, enabling Tesla to offer competitive pricing for its vehicles.

In conclusion, the US lithium battery industry is a promising sector with immense potential for growth. As the world continues to embrace renewable energy and technological innovation, investing in lithium battery stocks could prove to be a wise decision. However, it's crucial to conduct thorough research and stay informed about market trends to maximize your investment returns.

us stock market today