India ETF US Stock: A Strategic Investment Opportunity

author:US stockS -

Investing in international markets can be a rewarding endeavor, but it also comes with its own set of challenges. One such challenge is navigating the complexities of the Indian stock market, which is known for its volatility and diversity. To simplify this process, many investors are turning to India ETFs (Exchange Traded Funds) listed on US stock exchanges. This article delves into the benefits and considerations of investing in India ETF US stock.

Understanding India ETF US Stock

An India ETF US stock is a type of exchange-traded fund that tracks the performance of the Indian stock market. These funds are listed on US stock exchanges, making them accessible to American investors. By investing in an India ETF US stock, investors gain exposure to a broad range of Indian stocks without having to navigate the intricacies of the Indian market directly.

Benefits of Investing in India ETF US Stock

Diversification: One of the primary benefits of investing in an India ETF US stock is diversification. By investing in a basket of Indian stocks, investors can reduce their exposure to individual stock risk.

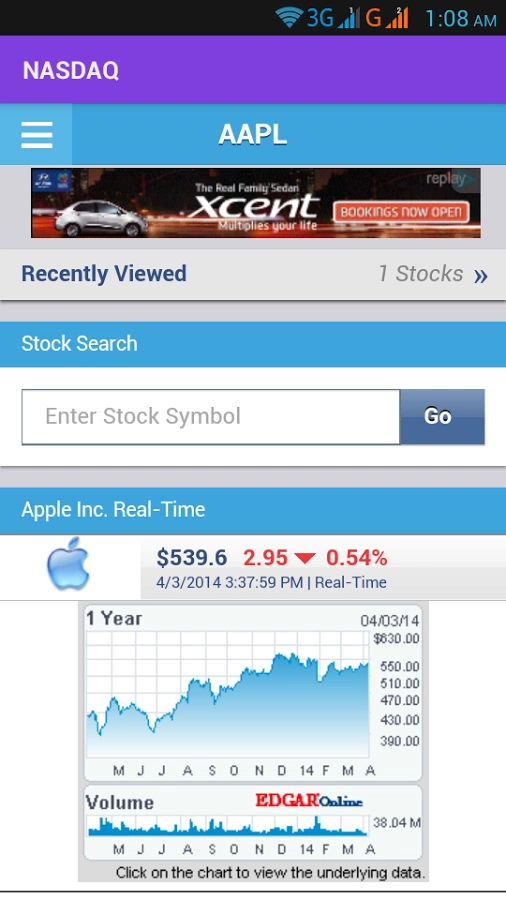

Accessibility: India ETF US stocks are listed on US stock exchanges, making them easily accessible to American investors. This eliminates the need for complex international trading platforms and currencies.

Liquidity: India ETF US stocks are highly liquid, allowing investors to buy and sell shares at any time during trading hours.

Professional Management: India ETF US stocks are managed by professional fund managers who have expertise in the Indian market. This ensures that the fund is well-diversified and actively managed.

Tax Efficiency: India ETF US stocks are subject to the same tax rules as other US stocks, making them tax-efficient for American investors.

Considerations for Investing in India ETF US Stock

Volatility: The Indian stock market is known for its volatility. While this can lead to significant gains, it also increases the risk of losses.

Currency Risk: Investing in India ETF US stock exposes investors to currency risk. If the Indian rupee weakens against the US dollar, it can negatively impact the returns of the ETF.

Economic and Political Factors: The Indian economy and political landscape can significantly impact the performance of India ETF US stocks. Investors should stay informed about these factors to make informed investment decisions.

Case Study: iShares MSCI India ETF (EPI)

One of the most popular India ETF US stocks is the iShares MSCI India ETF (EPI). This ETF tracks the performance of the MSCI India Index, which includes large- and mid-cap companies across various sectors of the Indian economy.

Over the past decade, EPI has delivered strong returns, outperforming many other major global stock indices. However, it's important to note that EPI has also experienced significant volatility during this period.

Conclusion

Investing in India ETF US stock can be a strategic way to gain exposure to the Indian market while mitigating some of the risks associated with international investing. However, it's crucial to conduct thorough research and stay informed about the market to make informed investment decisions.

us stock market today