Discover Financial Services: A Deep Dive into US Stocks

author:US stockS -

In the vast sea of US stocks, Discover Financial Services stands out as a reputable financial institution. This article aims to explore the ins and outs of Discover Financial Services, providing investors with a comprehensive understanding of its stock performance and potential.

Understanding Discover Financial Services

Discover Financial Services (DFS) is a leading financial services company based in the United States. It provides a wide range of financial products and services, including credit cards, personal loans, student loans, and deposit products. The company's roots date back to 1986, and it has since grown to become a significant player in the financial industry.

Stock Performance

Discover Financial Services has a strong track record when it comes to stock performance. Over the years, the company has demonstrated consistent growth and stability, making it an attractive investment opportunity for many.

Historical Stock Price Analysis

When analyzing the historical stock price of Discover Financial Services, it is evident that the stock has shown significant growth over the past decade. The stock price has consistently increased, with a few periods of consolidation and correction. This upward trend can be attributed to the company's strong financial performance and growth initiatives.

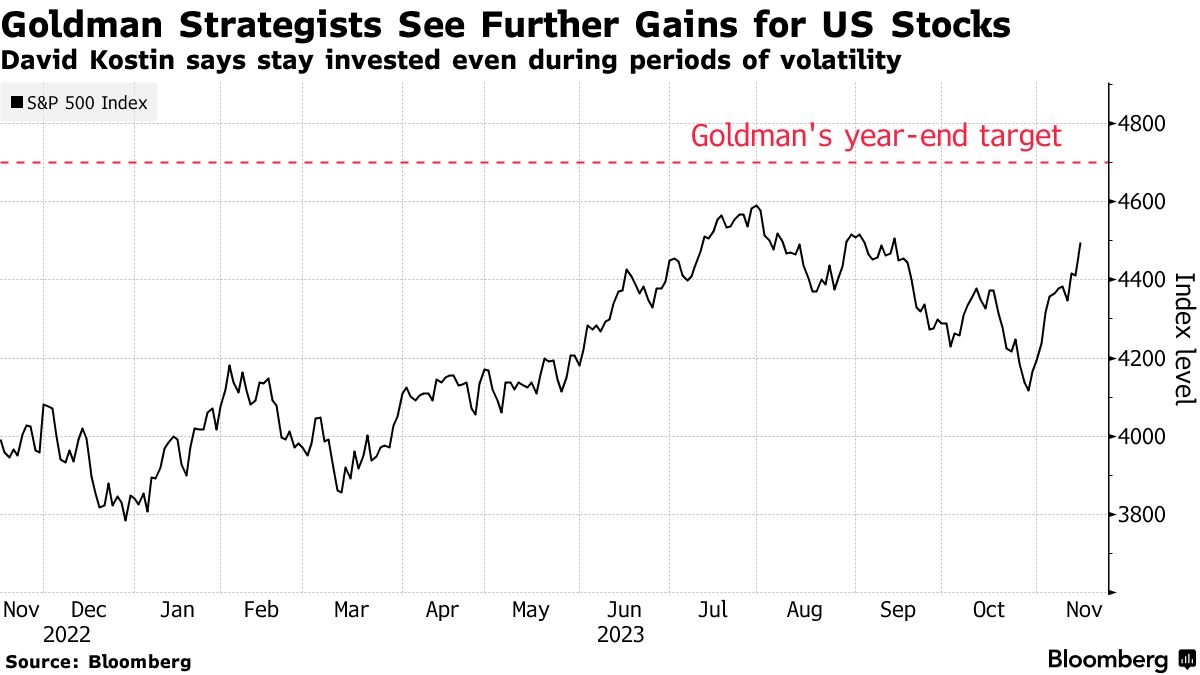

Recent Stock Price Movement

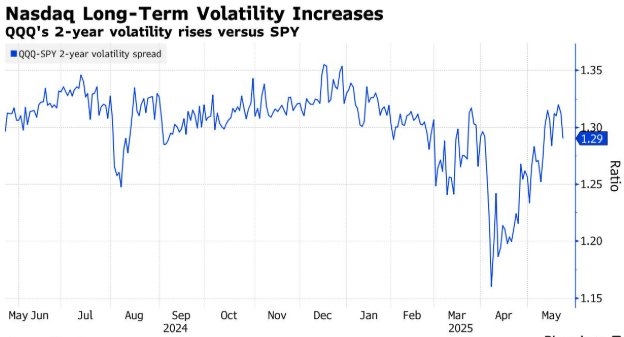

In the recent past, the stock price of Discover Financial Services has experienced some volatility. However, it has maintained a positive overall trend, reflecting the company's strong fundamentals. Investors should keep a close eye on the latest market trends and economic indicators to make informed decisions.

Key Factors Influencing Stock Performance

Several key factors influence the stock performance of Discover Financial Services. These include:

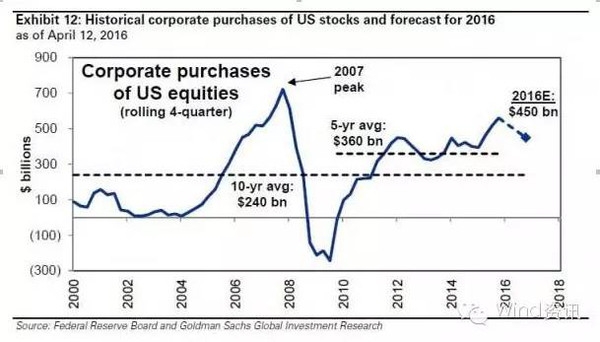

Economic Conditions: The overall economic environment plays a crucial role in the financial performance of Discover Financial Services. Economic growth, interest rates, and consumer spending are some of the key indicators to watch.

Company Performance: The financial health and performance of Discover Financial Services are vital in determining its stock price. Key metrics such as revenue, earnings, and profitability are closely monitored by investors.

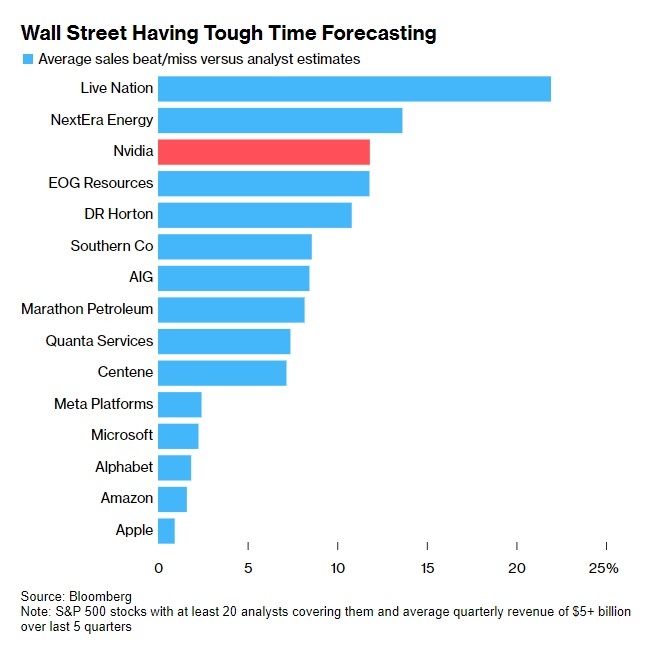

Market Trends: Market trends and investor sentiment can significantly impact the stock price. Keeping an eye on industry trends and market dynamics is essential for making informed decisions.

Case Study: Discover Financial Services and the Pandemic

The COVID-19 pandemic presented unprecedented challenges for the financial industry. Despite the uncertainties, Discover Financial Services demonstrated resilience and adaptability. The company took several measures to support its customers, including offering payment deferrals and providing financial assistance. These actions helped maintain customer trust and contributed to the company's stock performance during these challenging times.

Conclusion

Investing in Discover Financial Services can be a wise decision for those looking for stability and growth in the US stock market. With a strong track record and a solid financial foundation, Discover Financial Services continues to be a compelling investment opportunity. However, as with any investment, it is crucial to conduct thorough research and consider various factors before making a decision.

us stock market today