Unlocking the Potential of Small Cap US Stock Indexes

author:US stockS -

In the vast landscape of the U.S. stock market, small cap stocks often fly under the radar, yet they hold immense potential for investors seeking high growth opportunities. The Small Cap US Stock Index is a vital tool for investors looking to diversify their portfolios and capitalize on emerging trends. This article delves into the world of small cap stocks, exploring their characteristics, risks, and the strategies for investing in them effectively.

Understanding Small Cap Stocks

Small cap stocks are shares of companies with a market capitalization of less than $2 billion. These companies are typically less established and have a smaller market presence compared to their larger counterparts. The small cap segment is often considered a bellwether for the health of the broader economy and a fertile ground for high-growth companies.

Risks and Rewards

Investing in small cap stocks carries both significant risks and rewards. On one hand, these companies often experience rapid growth, leading to substantial returns. On the other hand, they are more susceptible to market volatility, economic downturns, and regulatory changes. It's crucial for investors to conduct thorough research and have a long-term perspective when investing in this segment.

Key Considerations for Investing in Small Cap Stocks

Market Research: Conduct comprehensive research to identify promising small cap companies. Look for companies with strong fundamentals, such as solid revenue growth, profitability, and a clear competitive advantage.

Diversification: Diversify your portfolio by investing in a mix of small cap stocks across different industries and geographic regions. This approach can help mitigate risks associated with market volatility.

Risk Management: Implement risk management strategies, such as setting stop-loss orders and diversifying your investments. It's important to have a clear understanding of your risk tolerance and investment objectives.

Regular Monitoring: Stay informed about the performance of your investments and the overall market conditions. Regular monitoring allows you to make informed decisions and adjust your portfolio as needed.

Case Studies: Successful Small Cap Investments

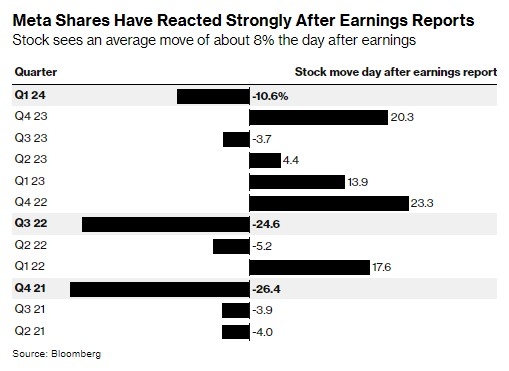

Facebook (now Meta Platforms, Inc.): Once a small cap stock, Facebook has grown to become one of the largest and most influential companies in the world. Investing in Facebook at an early stage would have resulted in significant returns.

Tesla, Inc.: Another example of a small cap stock that has transformed into a market leader. Investing in Tesla early on would have provided substantial gains.

Conclusion

Investing in the Small Cap US Stock Index can be a lucrative strategy for investors seeking high growth opportunities. However, it's essential to conduct thorough research, diversify your portfolio, and manage risks effectively. By following these guidelines and staying informed about market trends, investors can unlock the potential of small cap stocks and achieve their investment goals.

us stock market live