Sale of Stock: Understanding the US Stock Market Dynamics

author:US stockS -

The stock market has always been a place where investors can potentially earn substantial returns. The US stock market, in particular, is known for its liquidity, diversity, and size. Selling stocks is a crucial aspect of investing, and understanding the dynamics involved can make the process more profitable. This article delves into the sale of stocks in the US, offering insights and strategies for investors looking to cash out or rebalance their portfolios.

What is the Sale of Stock?

The sale of stock refers to the act of selling shares of a company you own to another investor. It is a way to liquidate your investment and potentially earn a profit, depending on the market conditions and the price at which you sell. The process involves finding a buyer, negotiating a price, and completing the transaction through a brokerage firm.

Understanding the US Stock Market Dynamics

Before diving into the sale of stocks, it's crucial to have a basic understanding of the US stock market dynamics. The market is primarily composed of two types of exchanges: the New York Stock Exchange (NYSE) and the Nasdaq. Companies listed on these exchanges trade their shares, and the prices fluctuate based on various factors such as company performance, economic conditions, and investor sentiment.

Key Considerations When Selling Stocks

When considering selling stocks, there are several factors to keep in mind:

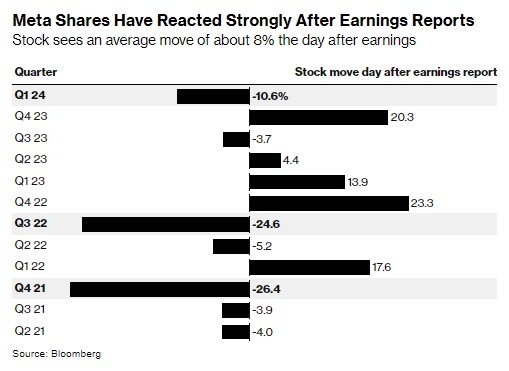

Market Conditions: The stock market can be highly volatile, and prices can change rapidly. It's essential to assess the current market conditions and determine the best time to sell.

Tax Implications: Selling stocks can have tax implications, depending on whether you hold the shares for a short or long term. It's crucial to understand the capital gains tax rates and potential tax liabilities.

Investment Goals: Evaluate your investment goals and determine whether selling stocks aligns with your long-term strategy. Selling stocks prematurely might not be in your best interest if your goal is long-term growth.

Dividends and Capital Gains: Consider whether you are selling stocks to reinvest the proceeds into a new investment or to receive dividends. Selling stocks that are generating significant dividends can impact your income.

Strategies for Selling Stocks

To maximize the returns on your investment, consider the following strategies:

Use a Brokerage Firm: A brokerage firm can help you execute the sale of stocks, providing you with access to the market and guidance on the best time to sell.

Diversify Your Portfolio: Selling stocks can be an excellent opportunity to rebalance your portfolio and invest in new assets. Consider diversifying your investments to reduce risk.

Set Realistic Expectations: While it's natural to aim for the highest possible return, it's crucial to set realistic expectations and be prepared for potential market fluctuations.

Case Studies

To illustrate the importance of understanding the sale of stocks, let's consider a few case studies:

Case Study 1: An investor held shares of a technology company that experienced a significant price increase over the years. When the stock reached its peak, the investor sold the shares, earning a substantial profit.

Case Study 2: An investor held shares of a dividend-paying utility company for a long time. When the investor decided to retire, they sold the shares to reinvest the proceeds into a fixed-income investment.

By understanding the sale of stocks and the US stock market dynamics, investors can make informed decisions and potentially maximize their returns. Always consult with a financial advisor to tailor your investment strategy to your specific needs and goals.

us stock market live