US Stock Market: Is It a Bubble?

author:US stockS -

The US stock market has been a beacon of prosperity for investors over the years. However, there's a growing consensus among market analysts and experts that the current market might be teetering on the edge of a bubble. This article delves into the reasons behind this concern, examines historical parallels, and evaluates the potential consequences if the bubble were to burst.

The Argument for a Bubble

One of the primary arguments for the existence of a stock market bubble is the current level of stock valuations. Many stocks, particularly those in the tech sector, are trading at multiples that far exceed their historical averages. For instance, the price-to-earnings (P/E) ratio for the S&P 500 index is currently around 21, which is significantly higher than the long-term average of around 15.

Excessive Debt and Speculation

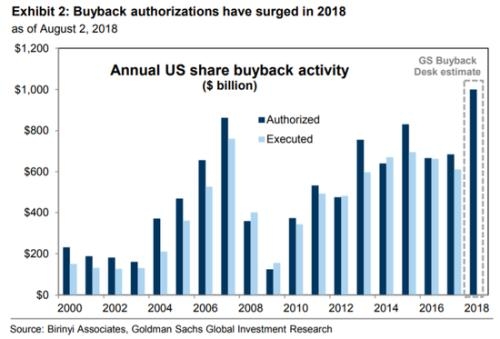

Another factor contributing to the bubble theory is the excessive debt levels among companies. Many companies have been taking on massive amounts of debt to finance share buybacks and acquisitions, which has driven up stock prices. Additionally, the rise of passive investing and the increased flow of capital into the stock market have led to a speculative frenzy, further inflating stock prices.

Historical Parallels

History has shown that stock market bubbles often occur during periods of low interest rates and excessive optimism. The dot-com bubble of the late 1990s and the housing bubble of the mid-2000s are prime examples. Both of these bubbles were characterized by irrational exuberance, excessive debt, and valuations that were far beyond any reasonable measure of intrinsic value.

Potential Consequences

If the US stock market is indeed a bubble, the potential consequences of a burst could be severe. A sudden drop in stock prices could lead to a financial crisis, similar to the 2008 financial crisis. This could have a ripple effect on the broader economy, leading to a recession, job losses, and a decline in consumer confidence.

Case Studies

To illustrate the potential consequences of a stock market bubble, let's look at the dot-com bubble. The bubble burst in 2000, leading to a massive sell-off in tech stocks. The NASDAQ index, which was the benchmark for tech stocks, lost more than 70% of its value in just two years. This had a significant impact on the economy, leading to a recession and a rise in unemployment.

Conclusion

The question of whether the US stock market is a bubble is a complex one. While there are clear signs of excessive optimism and valuations, it's difficult to predict when and if the bubble will burst. Investors should be cautious and conduct thorough research before making investment decisions. As always, the key to successful investing is diversification and a long-term perspective.

us stock market live