Understanding the Bourse Index: A Comprehensive Guide

author:US stockS -

In the world of finance, the bourse index is a crucial tool for investors and traders to gauge the overall performance of a stock market. Whether you are a seasoned investor or just starting out, understanding the bourse index can provide valuable insights into market trends and potential investment opportunities. This article delves into the meaning of the bourse index, its importance, and how it can be used to make informed investment decisions.

What is a Bourse Index?

A bourse index, often referred to as a stock market index, is a statistical measure of the value of a basket of securities, typically stocks. These indices are designed to reflect the overall performance of a particular market or sector. The most well-known bourse index is the S&P 500, which tracks the performance of 500 large companies listed on the New York Stock Exchange and NASDAQ.

Why is the Bourse Index Important?

The bourse index serves several important purposes:

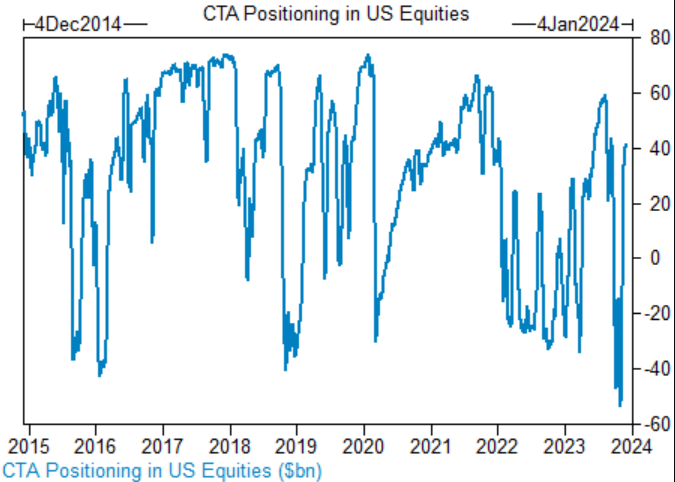

Market Performance Tracking: By tracking the performance of a basket of securities, the bourse index provides a quick and easy way to gauge the overall health of a market. It allows investors to compare the current market conditions with historical data, helping them make informed decisions.

Investment Decision Making: The bourse index can be a valuable tool for investors looking to allocate their capital. By analyzing the performance of different indices, investors can identify sectors or markets that are performing well and potentially offer higher returns.

Market Trends Analysis: The bourse index can reveal important market trends and patterns. For example, a rising index may indicate a strong market sentiment, while a falling index may suggest a bearish market.

Understanding Different Bourse Indices

There are various bourse indices available, each catering to different markets and sectors. Here are a few notable examples:

S&P 500: As mentioned earlier, the S&P 500 is a widely followed index that tracks the performance of 500 large companies in the United States.

Dow Jones Industrial Average (DJIA): The DJIA is another popular index that tracks the performance of 30 large companies listed on the New York Stock Exchange and NASDAQ.

NASDAQ Composite: The NASDAQ Composite tracks the performance of all stocks listed on the NASDAQ exchange, making it a good representation of the technology sector.

FTSE 100: The FTSE 100 is an index of the 100 largest companies listed on the London Stock Exchange, providing insights into the UK market.

Case Study: The S&P 500 and the 2008 Financial Crisis

One notable example of the importance of bourse indices is the 2008 financial crisis. As the crisis unfolded, the S&P 500 experienced a significant decline, reflecting the broader market's turmoil. Investors who monitored the index and recognized the early signs of the crisis were able to take appropriate action to protect their investments.

Conclusion

Understanding the bourse index is essential for anyone involved in the stock market. By tracking the performance of a basket of securities, these indices provide valuable insights into market trends and potential investment opportunities. Whether you are a seasoned investor or just starting out, familiarizing yourself with the different bourse indices can help you make informed decisions and navigate the complex world of finance.

us stock market live