How Accurate Is Stock Investing in the US?

author:US stockS -

Investing in the stock market is a popular way to grow wealth, but how accurate is it, especially in the US? With a variety of strategies, tools, and data at investors' disposal, this article explores the accuracy of stock investing in the US, providing insights and valuable tips for potential and seasoned investors.

Understanding the Stock Market in the US

The US stock market, also known as the American stock market, is one of the largest and most influential in the world. It's composed of two major stock exchanges: the New York Stock Exchange (NYSE) and the Nasdaq. Both of these exchanges offer a vast array of stocks representing different industries, sectors, and companies from around the globe.

Accuracy in Stock Investing: Factors to Consider

1. Market Volatility

The stock market is known for its volatility, which can affect the accuracy of investment outcomes. Market volatility refers to the degree of variation in a stock's price over a certain period of time. While some investors may thrive in volatile markets, others may struggle with the uncertainty. Therefore, the accuracy of stock investing can be influenced by an individual's risk tolerance.

2. Stock Selection

Accurate stock investing often relies on selecting the right stocks. This can be achieved through extensive research, analyzing financial statements, understanding industry trends, and evaluating a company's management team. The more thorough the analysis, the higher the accuracy of the investment decision.

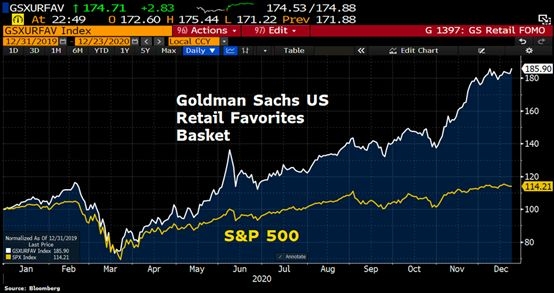

3. Market Trends

Keeping up with market trends is crucial in stock investing. This involves staying informed about economic indicators, geopolitical events, and corporate earnings reports. By understanding these trends, investors can make more accurate predictions about stock price movements.

4. Diversification

Diversification is a key element in accurate stock investing. It involves spreading investments across various asset classes and sectors to reduce risk. By diversifying, investors can protect themselves from the volatility of any single stock or market segment.

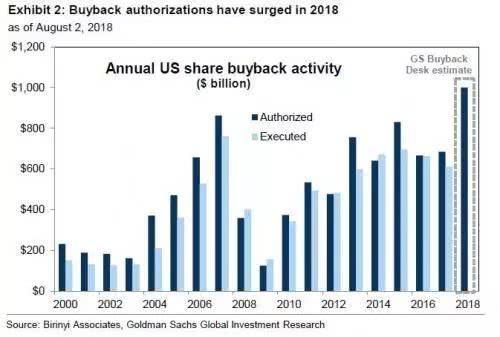

5. Financial Tools and Data

The availability of financial tools and data has greatly improved the accuracy of stock investing. Investors can use advanced software, analytical models, and real-time data to make informed decisions. However, it's essential to be cautious of over-relying on these tools and to understand their limitations.

Case Studies: Success Stories and Lessons Learned

One notable success story in stock investing is Warren Buffett, who has consistently achieved exceptional returns by focusing on value investing. Buffett's approach involves identifying companies with strong fundamentals and long-term potential.

On the other hand, some investors may have experienced setbacks, such as the dot-com bubble of the late 1990s or the financial crisis of 2008. These events highlight the importance of due diligence, diversification, and a long-term perspective.

Conclusion

In conclusion, the accuracy of stock investing in the US can be influenced by various factors, including market volatility, stock selection, market trends, diversification, and the use of financial tools and data. While it's impossible to guarantee accuracy in stock investing, by understanding these factors and adopting a well-rounded approach, investors can increase their chances of success. Remember, the key to successful stock investing lies in thorough research, discipline, and a long-term perspective.

us stock market live