US Stock Completion Index: A Comprehensive Guide

author:US stockS -

In the ever-evolving world of finance, staying ahead of the curve is essential for investors and traders. One crucial tool that has gained popularity in recent years is the US Stock Completion Index (USCI). This index is designed to provide a snapshot of the broader market, offering insights into the performance and trends of various stocks. In this article, we will delve into the details of the USCI, its significance, and how it can be a valuable asset in your investment strategy.

Understanding the US Stock Completion Index

The US Stock Completion Index is a market index that tracks the performance of a diverse set of stocks across various sectors and market capitalizations. Unlike traditional indices like the S&P 500 or the Dow Jones Industrial Average, the USCI aims to capture the entire market's performance, providing a more comprehensive view of the stock market's health.

How is the USCI Calculated?

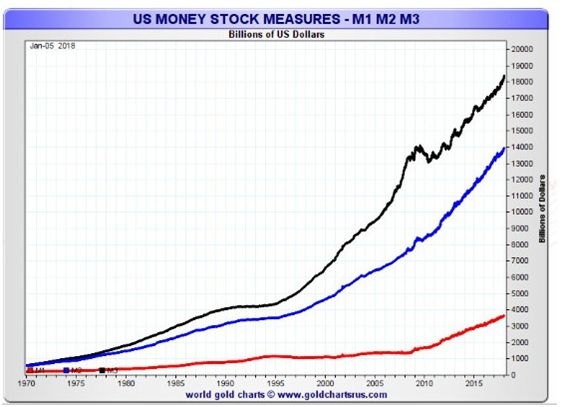

The USCI is calculated using a unique methodology that includes a broad range of stocks. It takes into account market capitalization, industry representation, and liquidity, ensuring that it reflects the overall market's performance accurately.

The Significance of the US Stock Completion Index

One of the primary reasons the USCI is so valuable is its ability to provide a holistic view of the market. By tracking a wide range of stocks, it helps investors understand the market's direction and potential risks. Here are some key reasons why the USCI is significant:

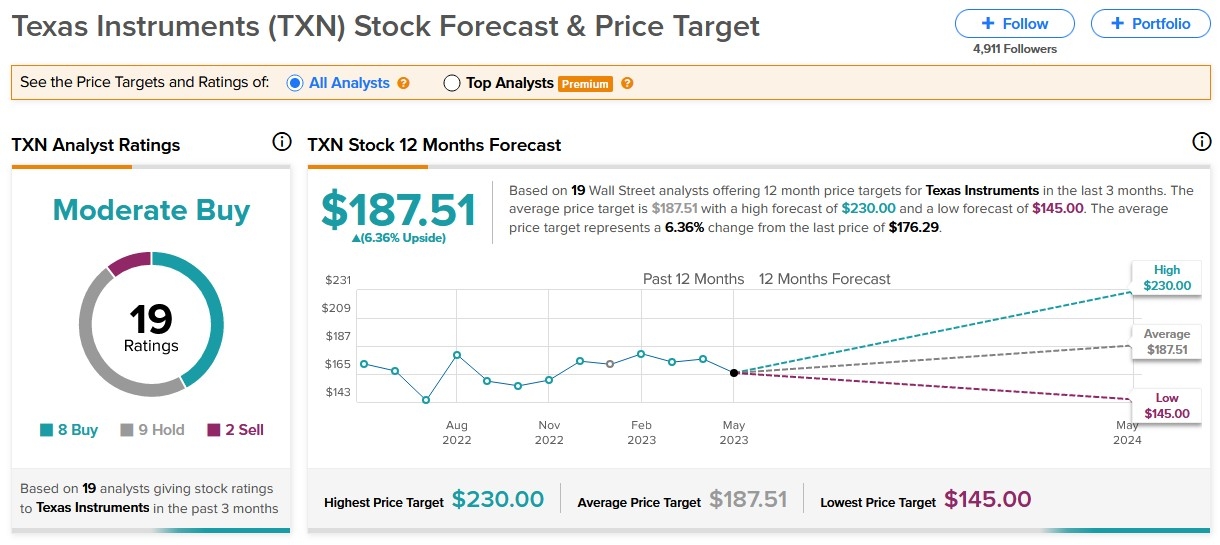

Market Health: The USCI offers a real-time snapshot of the market's health, making it easier for investors to identify trends and make informed decisions.

Diversification: By tracking a diverse set of stocks, the USCI helps investors gain exposure to various sectors and market capitalizations, reducing the risk of market volatility.

Investment Opportunities: The USCI can highlight sectors or stocks that are performing exceptionally well, providing valuable insights for investors seeking new opportunities.

Risk Management: Understanding the overall market's performance can help investors manage their risks more effectively.

Case Studies: How the US Stock Completion Index Has Influenced Investment Decisions

To illustrate the value of the USCI, let's consider a few case studies:

Tech Sector Performance: In 2021, the tech sector experienced significant growth. By analyzing the USCI, investors could identify this trend and allocate their capital accordingly.

Recession Indicators: During the 2008 financial crisis, the USCI showed a downward trend, alerting investors to the potential risks in the market.

Sector Rotation: The USCI helped investors identify sectors that were underperforming and rotate their investments accordingly.

Conclusion

The US Stock Completion Index is a powerful tool for investors and traders looking to gain a comprehensive understanding of the market. By tracking a diverse set of stocks, it provides valuable insights into market trends and potential risks. Incorporating the USCI into your investment strategy can help you make informed decisions and stay ahead of the curve.

us stock market live