Title: Can the US Government Dissolve Boeing Stock?

author:US stockS -

Introduction:

In the wake of the tragic Boeing crashes, there's been growing debate over the future of the aerospace giant and its place within the U.S. economy. One question that has sparked particular interest is whether the U.S. government has the authority to dissolve Boeing stock. This article delves into this topic, exploring the legal implications, potential consequences, and historical precedents surrounding the idea of a government intervention in the stock market.

Understanding the Question:

Before we proceed, it's crucial to clarify the question at hand. The term "dissolve" suggests a complete removal of Boeing's stock from the market, effectively rendering it worthless. However, it's important to note that such a measure would likely face significant legal and ethical challenges.

Legal Implications:

The authority to dissolve stock is primarily governed by federal securities laws, such as the Securities Exchange Act of 1934 and the Securities Act of 1933. These laws primarily focus on regulating the issuance and trading of securities rather than dissolving them.

The U.S. government has limited power to intervene in the stock market. The Federal Reserve can influence market conditions through monetary policy, but it does not have the authority to dissolve individual stocks. Additionally, the Department of Justice could potentially bring legal action against Boeing, but such action would not lead to the dissolution of stock.

Potential Consequences:

Dissolving Boeing stock could have significant consequences for the aerospace industry and the broader U.S. economy. Here are a few potential impacts:

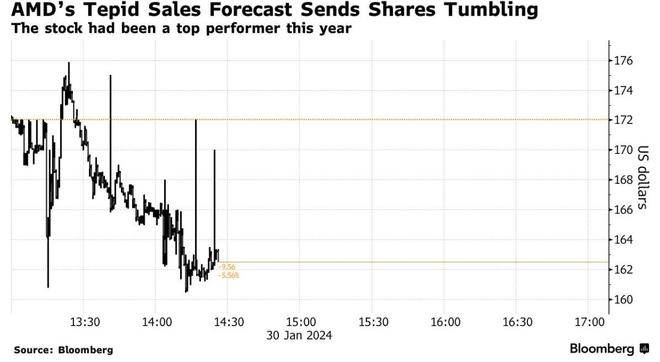

Financial Markets: Removing a large and influential stock like Boeing could create turmoil in financial markets, leading to uncertainty and volatility.

Economic Stability: Boeing is a major employer and supplier, contributing billions to the U.S. economy. Its collapse could have a ripple effect on related industries and the overall economy.

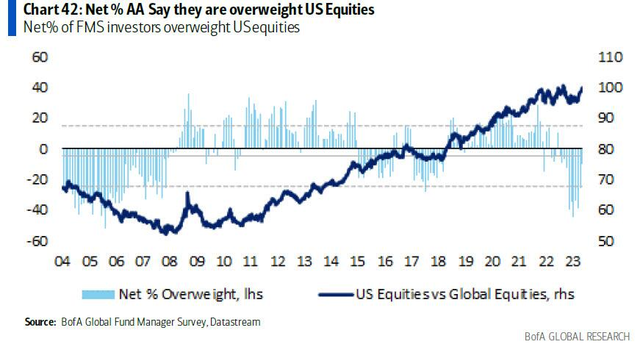

Investor Confidence: Dissolving Boeing stock could erode investor confidence in the U.S. stock market, leading to a decrease in foreign investment and long-term damage to the country's financial reputation.

Historical Precedents:

While the U.S. government has never dissolved a publicly traded stock, there have been instances where it has intervened in the stock market to prevent fraud and manipulation. For example, in the 1980s, the government imposed a "corporate raider" rule to limit the practice of acquiring and dissolving stocks for personal gain.

However, these interventions were aimed at protecting the integrity of the market rather than dissolving entire companies. The Boeing case presents a unique and unprecedented situation.

Conclusion:

While the question of whether the U.S. government can dissolve Boeing stock is an interesting one, it's clear that the legal and ethical challenges make such a move highly unlikely. The U.S. government must balance the need to hold Boeing accountable for its actions with the potential consequences of dissolving its stock. In the end, a more nuanced approach, such as legal action or other regulatory measures, may be the most viable option for addressing the Boeing situation.

us stock market live