How Indians Can Invest in US Stocks

author:US stockS -

Are you an Indian investor looking to diversify your portfolio and explore investment opportunities in the United States? Investing in US stocks can be a great way to gain exposure to one of the world's largest and most dynamic economies. In this article, we will guide you through the process of investing in US stocks from India, highlighting the key steps and considerations to keep in mind.

Understanding the Basics

Before diving into the investment process, it's essential to understand the basics of investing in US stocks. The US stock market is one of the most developed and regulated markets in the world, offering a wide range of investment options, including stocks, bonds, and ETFs (Exchange-Traded Funds).

Choosing a Broker

The first step in investing in US stocks is to choose a reliable and reputable broker. Several brokers offer services to Indian investors, allowing them to trade US stocks. Some popular options include TD Ameritrade, E*TRADE, and Charles Schwab. When selecting a broker, consider factors such as fees, customer service, and the availability of research tools.

Opening a Brokerage Account

Once you have chosen a broker, you will need to open a brokerage account. This process typically involves filling out an application form, providing identification documents, and linking your bank account for funding. Most brokers offer a user-friendly online platform that allows you to trade stocks, monitor your portfolio, and access research tools.

Understanding Risk and Reward

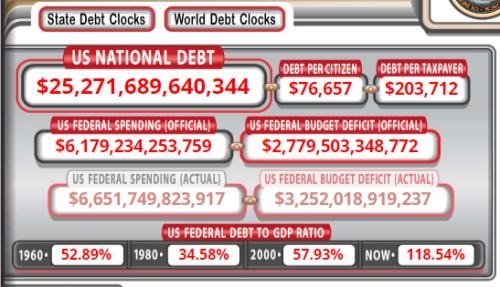

Investing in US stocks carries both risks and rewards. It's crucial to understand the potential risks involved, such as market volatility, currency fluctuations, and political uncertainties. However, with proper research and diversification, investing in US stocks can offer significant long-term returns.

Diversifying Your Portfolio

Diversification is a key strategy to mitigate risk and maximize returns. By investing in a variety of sectors and geographic regions, you can reduce your exposure to market-specific risks. Consider investing in sectors such as technology, healthcare, and consumer goods, as well as companies from different market capitalizations.

Using ETFs for Diversification

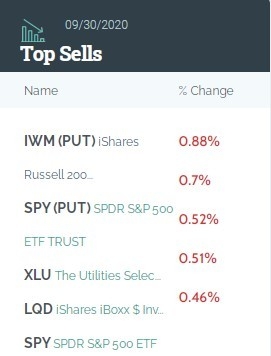

ETFs are a popular investment vehicle for diversifying your portfolio. They offer exposure to a basket of stocks, bonds, or commodities, allowing you to invest in a specific market or sector without having to buy individual stocks. For Indian investors, popular ETFs include the SPDR S&P 500 ETF (SPY) and the iShares MSCI Emerging Markets ETF (EEM).

Monitoring Your Investments

Once you have invested in US stocks, it's essential to monitor your portfolio regularly. Keep an eye on market trends, company news, and economic indicators that may impact your investments. Many brokers offer real-time alerts and portfolio tracking tools to help you stay informed.

Case Study: Investing in Apple Inc.

Let's consider a hypothetical scenario where an Indian investor decides to invest in Apple Inc. (AAPL), one of the world's most valuable companies. By researching the company's financials, market trends, and competitive landscape, the investor can make an informed decision on whether to buy, hold, or sell the stock.

In this case, the investor may decide to buy Apple Inc. shares, expecting the company's strong fundamentals and growth prospects to drive the stock's price higher. By diversifying their portfolio with other US stocks and ETFs, the investor can mitigate risk and potentially achieve higher returns.

In conclusion, investing in US stocks from India can be a rewarding experience for Indian investors looking to diversify their portfolios. By following the steps outlined in this article, you can navigate the process and make informed investment decisions. Remember to conduct thorough research, stay informed, and maintain a diversified portfolio to maximize your chances of success.

us stock market live