Stocks: A Journey Through U.S. History

author:US stockS -

The stock market has been a pivotal part of the American economy for over two centuries. From the birth of the nation to the digital age, the stock market has mirrored the growth, prosperity, and challenges of the United States. This article delves into the fascinating history of stocks in the U.S., highlighting key milestones and their impact on the nation's economic development.

The Birth of the Stock Market

The first stock exchange in the United States, the New York Stock Exchange (NYSE), was established in 1792. However, the concept of trading stocks had been in existence for several decades before that. The first stock exchange was founded in Philadelphia in 1790, but it was short-lived.

The early stock market was dominated by speculative trading and was heavily influenced by the country's political and economic climate. The market's early years were marked by volatility and speculation, particularly during the Panic of 1792 and the Panic of 1837.

The Rise of Industrialization

The 19th century saw the rise of industrialization, which had a profound impact on the stock market. As industries grew, so did the number of companies seeking capital through the issuance of stocks. The railroad industry, in particular, played a significant role in the expansion of the stock market during this period.

The construction of the transcontinental railroad in the 1860s was one of the most notable examples of the stock market's role in financing major infrastructure projects. The railroad industry's growth led to the creation of new companies and the expansion of existing ones, driving demand for stocks.

The Roaring Twenties

The 1920s were a period of unprecedented economic growth and prosperity in the United States. This era, often referred to as the "Roaring Twenties," saw the stock market soar to new heights. The Dow Jones Industrial Average (DJIA) reached an all-time high in 1929, just before the stock market crash that would come to define the decade.

The crash of 1929, known as the Great Depression, was a devastating event for the U.S. economy and the stock market. The market's rapid decline led to widespread unemployment, bank failures, and a profound loss of confidence in the financial system.

The New Deal and Post-War Years

The Great Depression prompted the government to take a more active role in regulating the stock market. The Securities Act of 1933 and the Securities Exchange Act of 1934 were enacted to ensure greater transparency and investor protection.

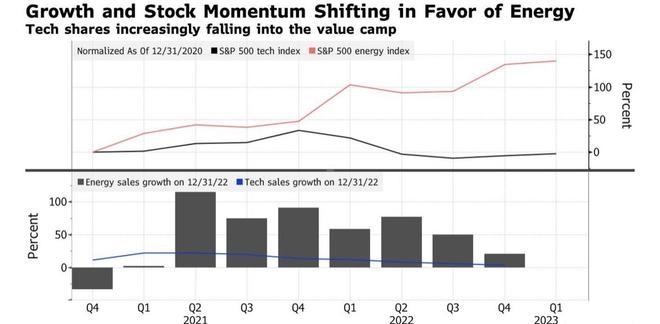

The post-World War II era saw the stock market recover and grow steadily. The growth of the technology sector, particularly in the 1990s, fueled the market's expansion and led to the creation of new investment vehicles such as exchange-traded funds (ETFs).

The Dot-Com Bubble and Beyond

The late 1990s and early 2000s were marked by the dot-com bubble, a period of rapid growth and speculative trading in internet-related stocks. The bubble burst in 2000, leading to a significant decline in the stock market.

The financial crisis of 2008 was another major event that shook the stock market. The crisis was triggered by the collapse of the housing market and subsequent banking failures. Despite the turmoil, the stock market has since recovered and continued to grow.

Conclusion

The history of stocks in the United States is a testament to the nation's economic resilience and growth. From the early days of speculative trading to the digital age, the stock market has played a vital role in shaping the American economy. As the market continues to evolve, it remains a crucial indicator of the country's economic health and a source of investment opportunities for millions of Americans.

us stock market live